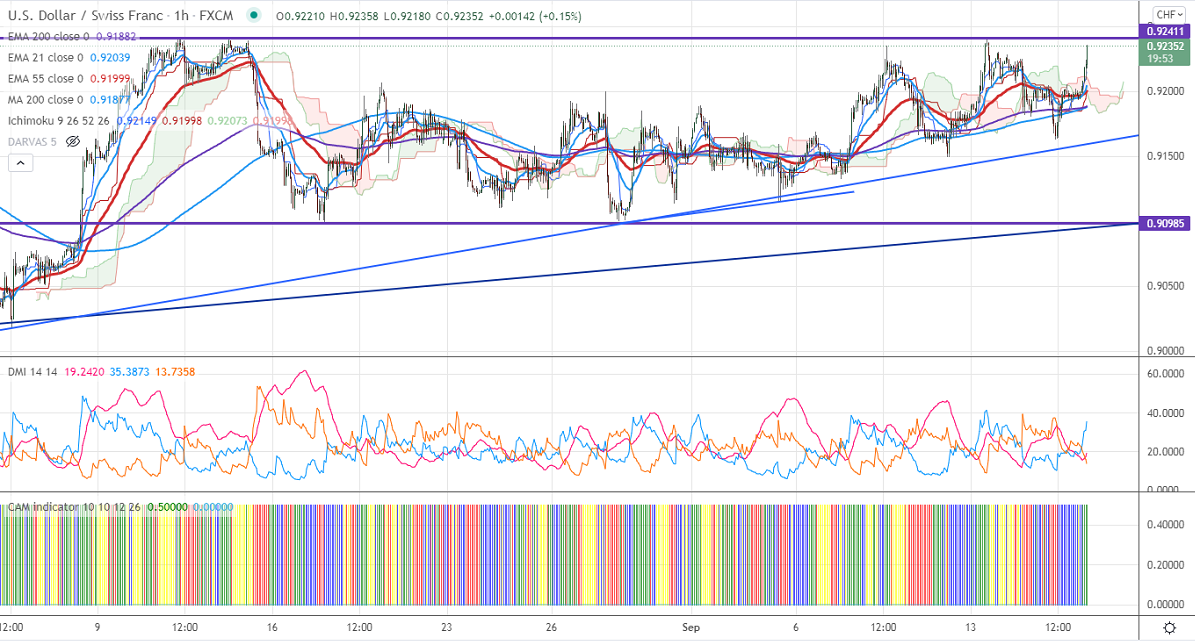

Ichimoku analysis (1 Hour chart)

Tenken-Sen- 0.92092

Kijun-Sen- 0.91941

June month high– 0.92750

The pair surged sharply and hits a fresh intraday high at 0.92280 on the strong US dollar. It has formed a bottom around 0.91637 for the week. Any breach below 0.9150 confirms further bearishness. At the time of writing, USDCHF is hovering around 0.92258 up 0.32%.

Economic data-

The headline New York Fed's US empire state manufacturing index rose to 34.3 in September vs. 18 expected. Markets eye US retail sales data, Philly fed manufacturing, and initial jobless claims data for further direction.

Trend-Neutral

The near-term resistance is around 0.9240, any breach above targets 0.9275/0.9365. The minor bearish trend from 0.94725 will get completed at 0.8940 only after it breaks 0.9275. On the lower side, immediate support is around 0.91800. Any convincing breach below will take to the next level 0.9150/ 0.91150/0.9995/0.90750/0.9050.

Indicator (Hourly chart)

CAM indicator –Bullish

Directional movement index –Bullish

It is good to buy on dips around 0.92000 with SL around 0.9160 for a TP of 0.9365.