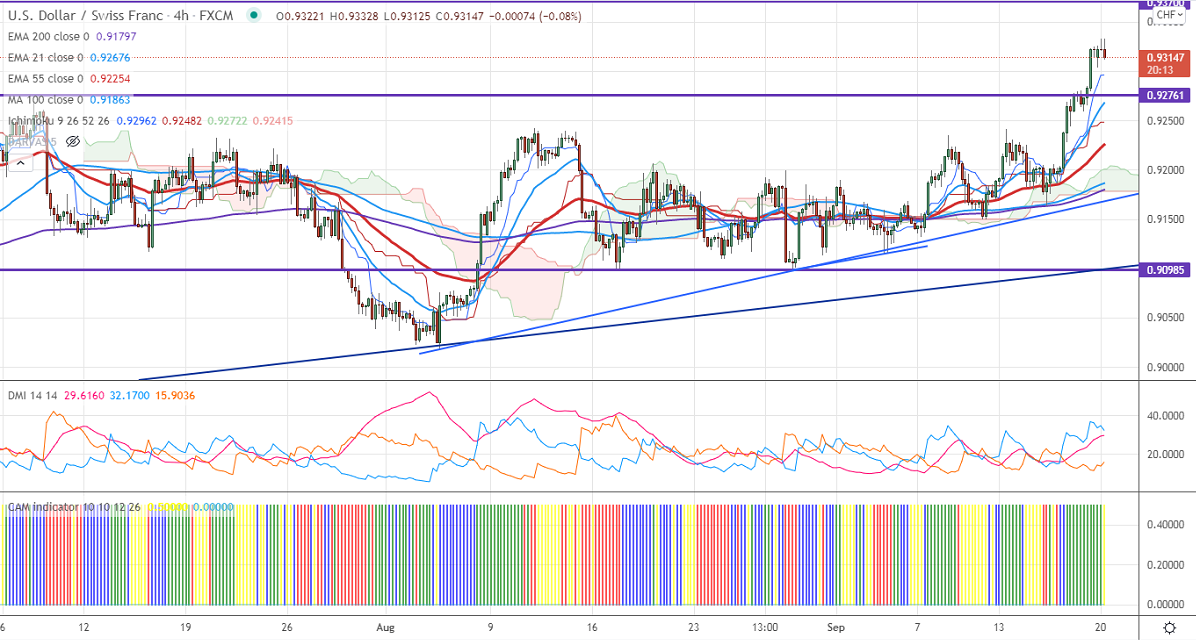

Ichimoku analysis (4 Hour chart)

Tenken-Sen- 0.92958

Kijun-Sen- 0.92482

The pair continues to trade higher for third consecutive days and more than 150 pips. The US dollar index jumped sharply after upbeat US economic data will increase the chance of tapering of bond buying. At the time of writing, USDCHF is hovering around 0.93164 down -0.06%.

Economic data-

Markets eye US Fed monetary policy meeting which is to be held on Sep 22nd for further direction.

Trend-Neutral

USDCHF is trading above 0.9300 and facing strong resistance at 100- W MA (0.93325). Any breach above 0.93350 confirms the short-term uptrend. A jump to 0.9400/0.94725 is possible. On the lower side, immediate support is around 0.9300. Any convincing breach below will take to the next level 0.9270/ 0.9240/ 0.9180.

Indicator (4-hour chart)

CAM indicator –Bullish

Directional movement index –Bullish

It is good to buy on dips around 0.9300 with SL around 0.9240 for a TP of 0.94725.