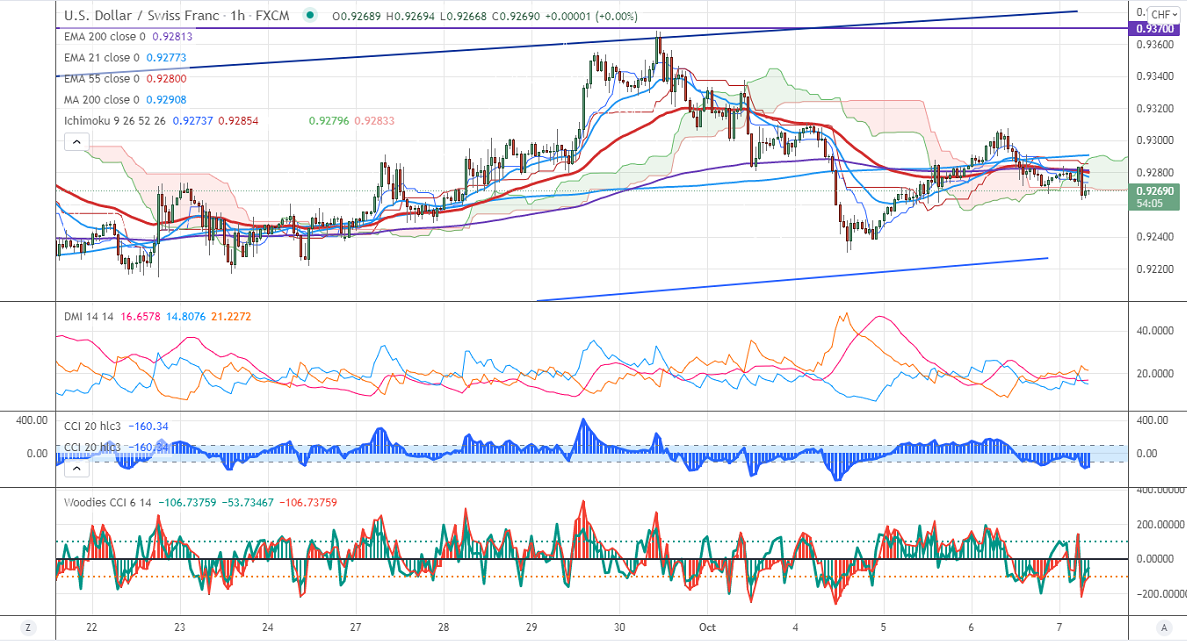

Major Intraday resistance -0.9320

Intraday support- 0.92150

It is trading in a narrow range between 0.92380 and 0.93072 for the past three days. The US dollar pared some of its gains as investors are optimistic about the US debt ceiling deal. The US dollar index declined after hitting a high of 94.44. Any breach above 94.50 confirms further bullishness. The intraday trend is still bullish as long as support 0.92150 holds. At the time of writing, USDCHF is hovering around 0.92692 down 0.04%.

US ADP private payrolls increased by 568000 in September much above expectations of 475000. Markets eye US initial jobless claims for further direction.

Woodies and CCI analysis-

The Woodies CC and CCI (50) are trading below zero lines (bearish trend). In Woodies CCI only two consecutive bars below zero (6 bars should be below zero line for bearish trend confirmation).

Trend-Neutral

USDCHF is facing strong resistance around 0.9320. Any break above targets 0.9330/0.93685. It should surge past 0.9370 for further bullish continuation. A jump to 0.9400/0.94725 is possible. On the lower side, immediate support is around 0.92350. Any convincing breach below targets 0.92150/0.9180.

Indicator (1-hour chart)

Directional movement index - Neutral

It is good to sell on rallies around 0.9308-10 with SL around 0.9365 for a TP of 0.9180.