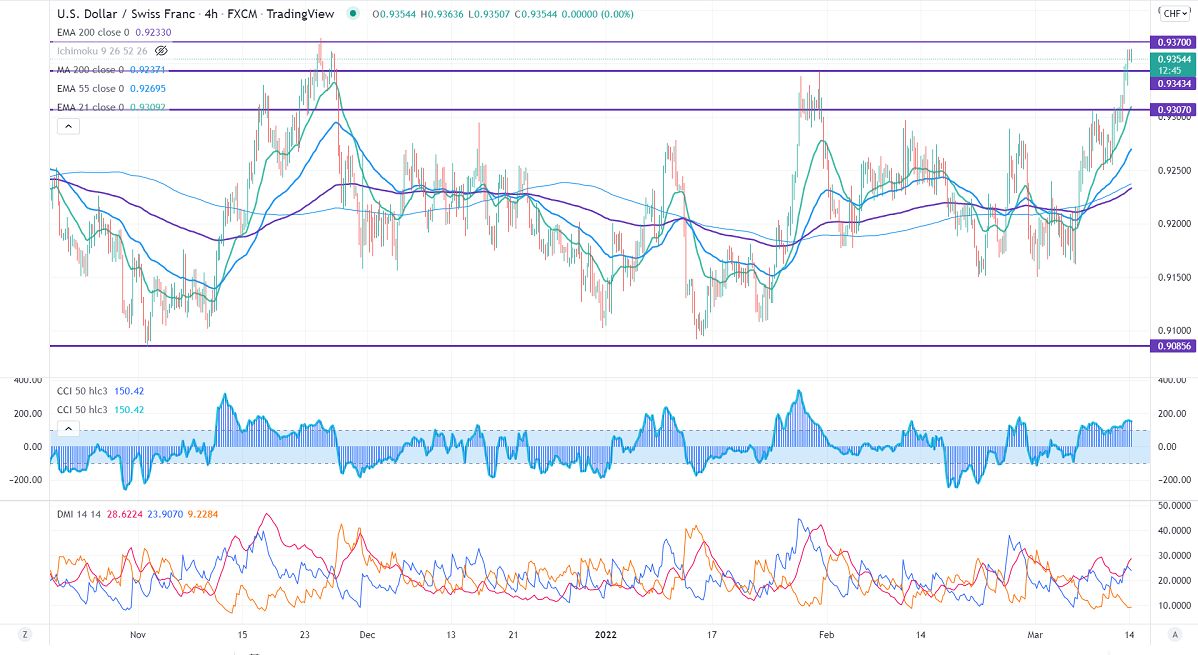

Intraday trend – Bullish

Significant intraday resistance – 0.9325

The pair is trading higher for the third consecutive day and jumped more than 100 pips. The risk aversion due to Russia and Ukraine wars has increased demand for the dollar. The 10-year US treasury yield holds well above 2% ahead of the Fed meeting. USDCHF hits a high of 0.93620 at the time of writing and is currently trading around 0.93521.

Bullish scenario-

The primary levels to Watch – 0.9385. Any convincing surge above confirms intraday bullishness. A jump to 0.9435/0.9500 is possible.

Bearish scenario-

Intraday support – 0.9300. Break below that level will take the pair to 0.9250/0.9200.

Indicators (4-Hour chart)

Directional movement index – Bullish

CCI (50) - Bullish

It is good to buy on dips around 0.9328-33 with SL around 0.92750 for a TP of 0.9400.