The pair pared gains made the previous week on US dollar profit booking. US dollar gained after Fed chairman comments. He said that the Central bank plans to be more aggressive if inflation pressure continues. US retail sales rose by 0.9% in Apr compared to 1%. Core sales jumped 0.6% vs. the Estimate of 0.4%. According to the CME Fed watch tool, the probability of a 50 bpbs rate hike rose to 90.5% from 86.2 a day ago.g 2011.USDCHF hits a high of 1.00492 and is currently trading around 1.00535.

Bullish scenario-

The primary level to Watch – is 1.0050. Any convincing surge above confirms intraday bullishness. A jump to 1.010/1.0235 is possible.

Bearish scenario-

Intraday support – 0.9980. Break below that level will take the pair to 0.9950/0.9900/0.9870.

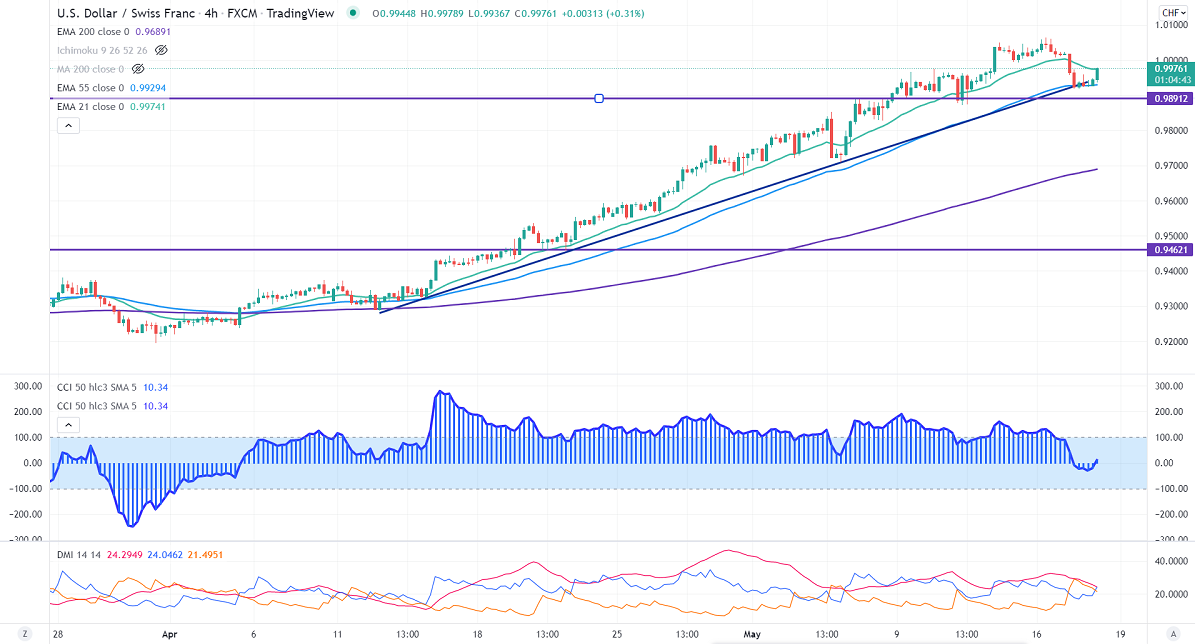

Indicators (4-hour chart)

Directional movement index – Bullish

CCI (50) - Bullish (Bearish divergence)- Minor selling can occur to 0.9900.

It is good to buy on dips around 0.9920 with SL around 0.9870 for a TP of 1.010.