USDCHF declined drastically sharply and lost more than 150 pips on board-based US dollar selling. Sales of US tech giants Microsoft and Alphabet rose marginally and missed the quarterly estimate. Company planning to cut its ad expenditure due to economic slowdown. The chance of an economic slowdown has increased the demand for safe-haven assets like the Swiss franc. US CB consumer confidence dropped to 102.5 in Oct vs. an estimate of 105.90. The US 10-year yield declined more than 6.5% after hitting a multi-year high of 4.33%. The US 10 and 2-year spread narrowed to -30 basis points from -57 bpbs.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Nov dropped to 91.7% from 94.6% a week ago.

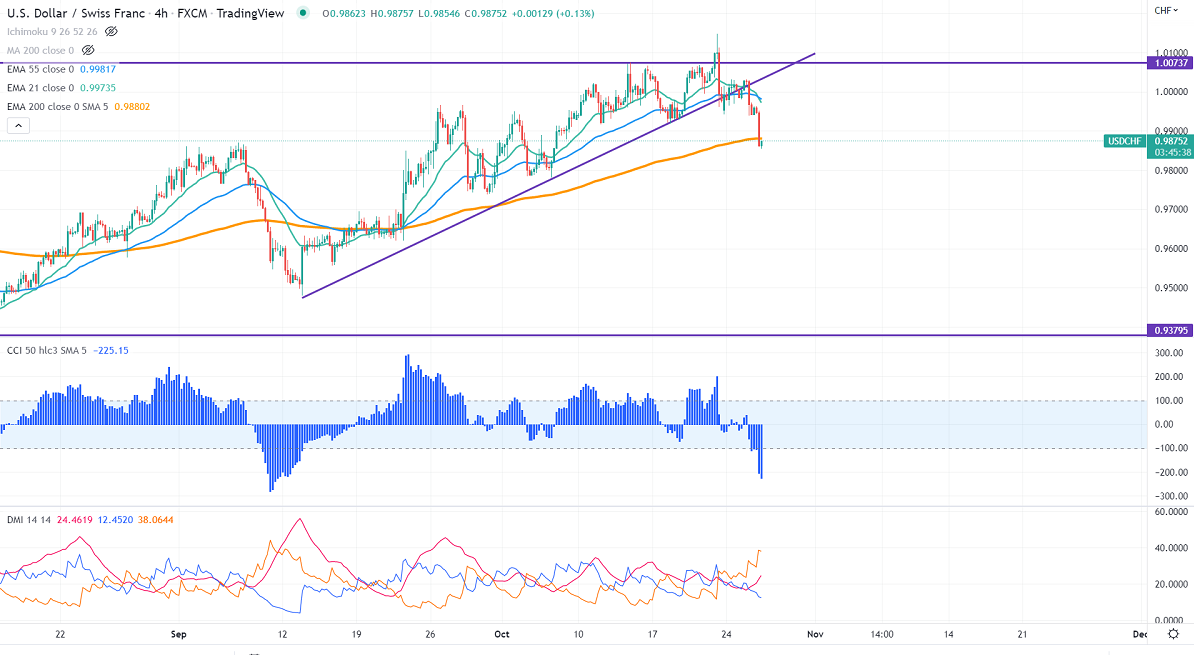

Technically in the 4-hour chart, the pair is holding below short-term (21 and 55 EMA) and long-term 200 EMA (0.98805). Any break below 0.9850 confirms further bearishness, a dip to 0.9780/0.9720 is possible. It hits an intraday low of 0.9860 and is currently trading around 0.98618.

The near-term resistance is around 0.9900 and any breach above targets 0.9960/1.0000. 0.9940/0.9900/0.9860.

Indicators (4-hour chart)

CCI (50)- Bearish

ADX- Bearish

It is good to sell on rallies around 0.9900 with SL around 0.9960 for a TP of 0.9725.