USDCHF lost more than 200 pips on weak US CPI data. Consumer prices rose 7.7% in Oct, down from the previous month's 8.2%, below the estimate of 8%. US dollar index hits seven-week low as chance of aggressive rate hike by Fed diminishes. It hits an intraday low of 0.96194 and is currently trading around 0.96360.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Dec dropped to 19.4% from 48% a week ago.

The US 10-year yield lost more than 10% after hitting a high of 4.244%. The US 10 and 2-year spread narrowed to -51.90 basis points from -67 bpbs.

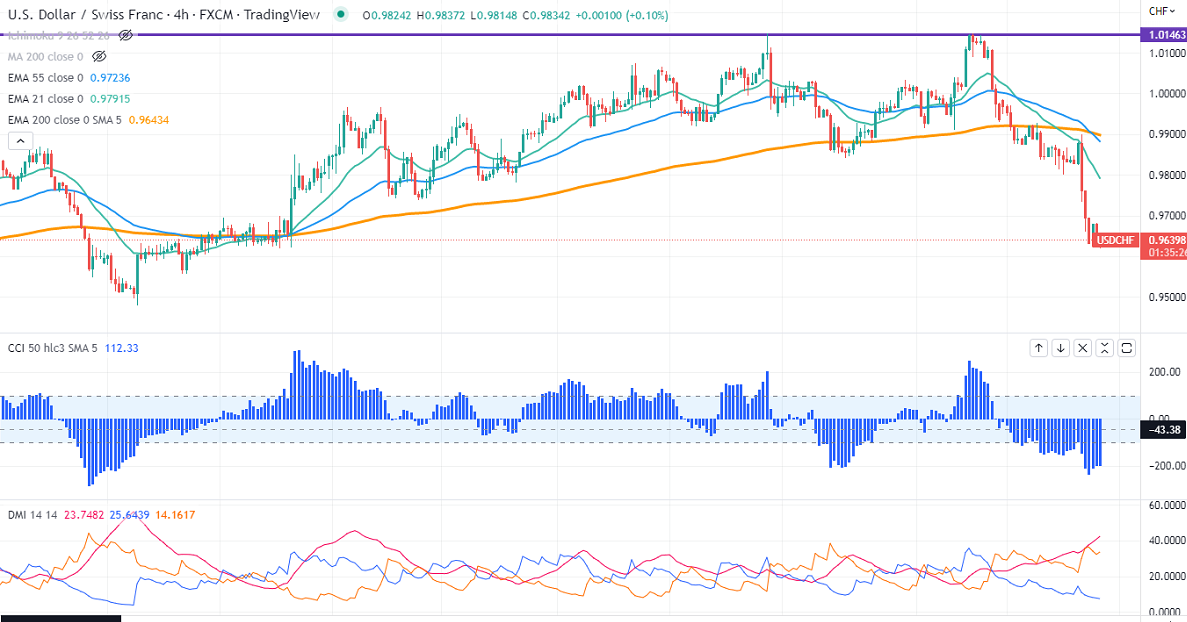

Technically in the 4-hour chart, the pair is holding below short-term (21 and 55 EMA) and long-term 200 EMA (0.99119). Any break below 0.9580 confirms further bearishness; a dip to 0.9528/0.9470 is possible.

The near-term resistance is around 0.9660 and any breach above targets is 0.9700/0.9780. Significant trend continuation only if it breaks 1.0150.

Indicators (4-hour chart)

CCI (50) - Bearish

ADX- Bearish

It is good to sell on rallies around 0.96680-70 with SL around 0.9730 for the TP of 0.9500.