USDCHF is trading flat due to subdued activity on Black Friday. The pair was one of the worst performers this month and lost more than 600 pips on board-based US dollar selling. Dovish comments from various Fed officials dragged the US dollar further down. It hits an intraday high of 0.94572 and is currently trading around 0.94332.

The US 10-year yield lost more than 4.5%. The US 10 and 2-year spread widened to -77 basis points from -57 bpbs.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Dec increased to 24.2% from 19.4% a week ago.

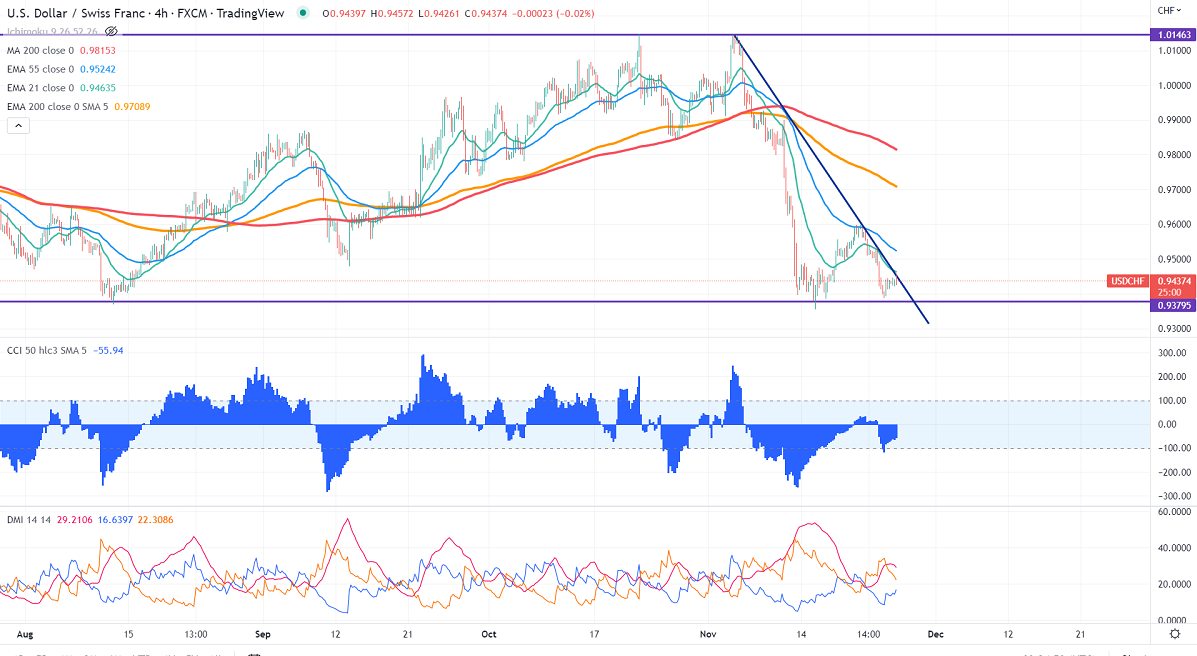

Technically in the 4-hour chart, the pair is holding below short-term (21 and 55 EMA) and above long-term 200 EMA (0.97115). Any break below 0.9370 confirms further bearishness, a dip to 0.9300/0.9230 is possible.

The near-term resistance is around 0.9500 and any breach above targets 0.9550/0.9600. Significant bullish continuation only if it breaks 1.0150.

Indicators (4-hour chart)

CCI (50)- Bearish

ADX- Neutral

It is good to sell on rallies around 0.9500 with SL around 0.9560 for the TP of 0.9300.