USDCHF breaks significant resistance of 1.000 on board-based US dollar buying on an escalation of tension between Russia and Ukraine. Russia attacked 75 missiles against Ukraine and killed 14 civilians.

According to the CME Fed watch tool, the probability of a 75 bpbs rate hike in Nov rose to 77.9% from 64.7% a week ago.

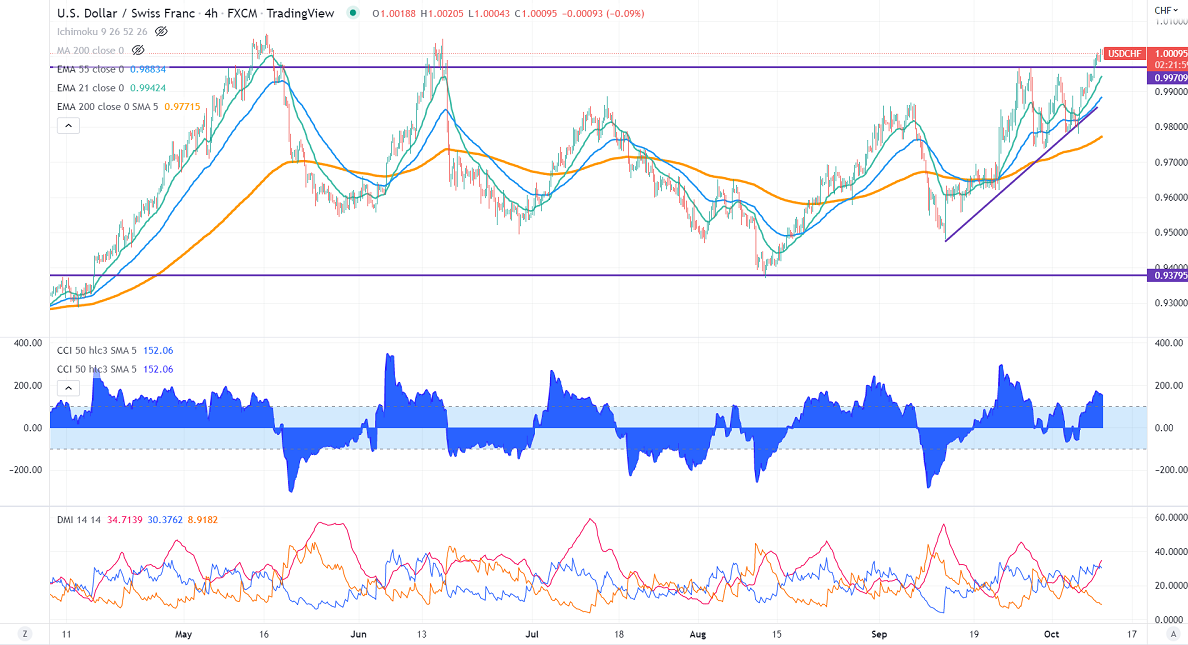

Technically in the 4-hour chart, the pair is holding above short-term (21- and 55 EMA) and 200 EMA (0.97563). Any break above 1.00500 will take the pair to 1.0130/1.0240. USDCHF hits an intraday high of 1.00211 and is currently trading around 1.00098.

The near-term support is around 0.9960 and any breach below targets 0.9900/0.9850/0.9780.

Indicators (4-hour chart)

CCI (50)- Bullish

ADX- Bullish

It is good to buy on dips around 1.000 with SL around 0.9960 for a TP of 1.0120.