FxWirePro- USDCHF Trade Idea

The pair recovered sharply after a minor sell-off. Overall bias remains bullish as long as support 0.8600 holds. It hit a high of 0.87929 at the time of writing and is currently trading around 0.87840.

The policy divergence between the US Fed and SNB supports the pair at lower levels.

The Swiss National Bank (SNB) is facing growing speculation about possible interest rate cuts in its upcoming meetings. Analysts believe the SNB may cut rates to address economic issues like inflation and currency stability, with a 25 basis point cut being likely and some even predicting a 50 basis point cut. The key policy rate was already reduced to 1% in September 2024 as part of three consecutive cuts. Inflation in Switzerland has eased to around 1.1%, which is below the SNB’s target, supporting the idea of more cuts. A survey suggests there could be two more cuts in December and March, lowering the rate to 0.5% by early 2025. The SNB also wants to prevent further appreciation of the Swiss franc, which could harm exports. Overall, expectations are leaning towards a rate cut to help economic growth and manage currency strength.

Technical Analysis

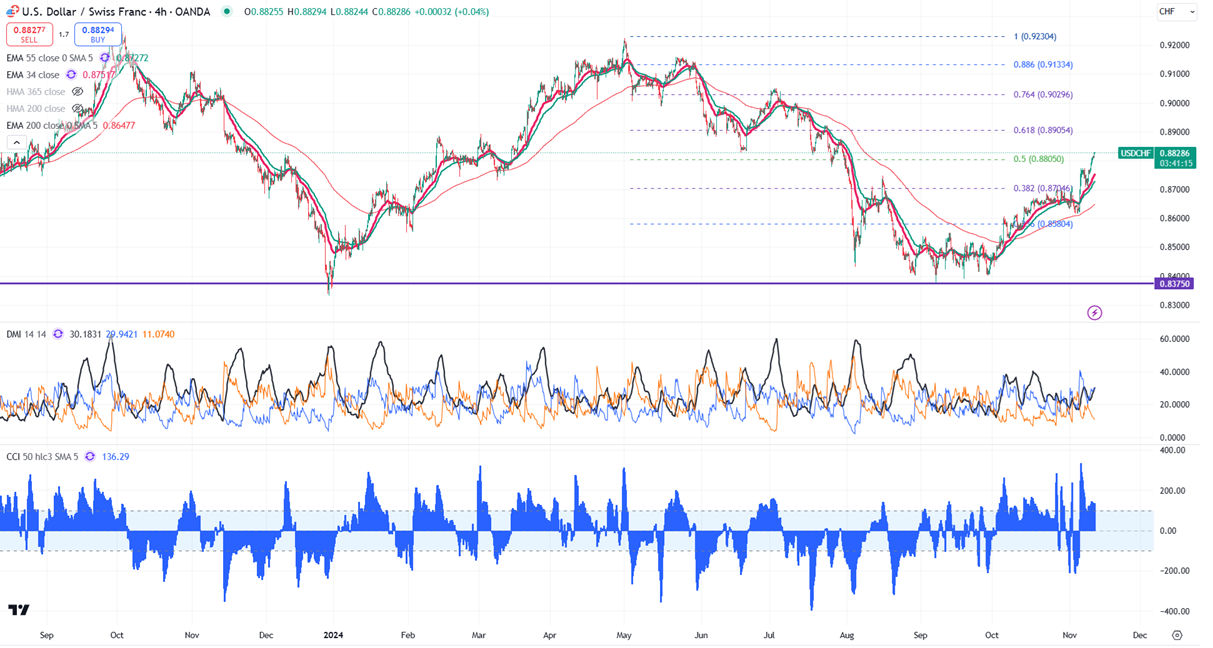

The pair is currently trading above the 34- and 55-EMA on the 4-hour chart.

Near-Term Resistance: Current resistance is at 0.8835. A break above this level could lead to targets at 0.8875/0.8900/0.8925. The break above 0.87500 confirms that a decline from 0.9225 was completed at 0.83750.

Immediate Support: The next support level is at 0.8750. If this level is broken, the pair could drop to 0.8700/0.8660/0.8600/0.8580, 0.8550, 0.8525, 0.8499, 0.8440, 0.8420, 0.8390, 0.8365 (61.8% Fibonacci projection), or even 0.8340.

Indicator Analysis (4-hour chart)

- CCI (50): Bullish

- Average Directional Movement Index: Bullish

Overall, the trend remains neutral

Trading Recommendation

Consider buying on dips around 0.8780, with a stop loss set at 0.8720, and aiming for a target price of 0.8925.