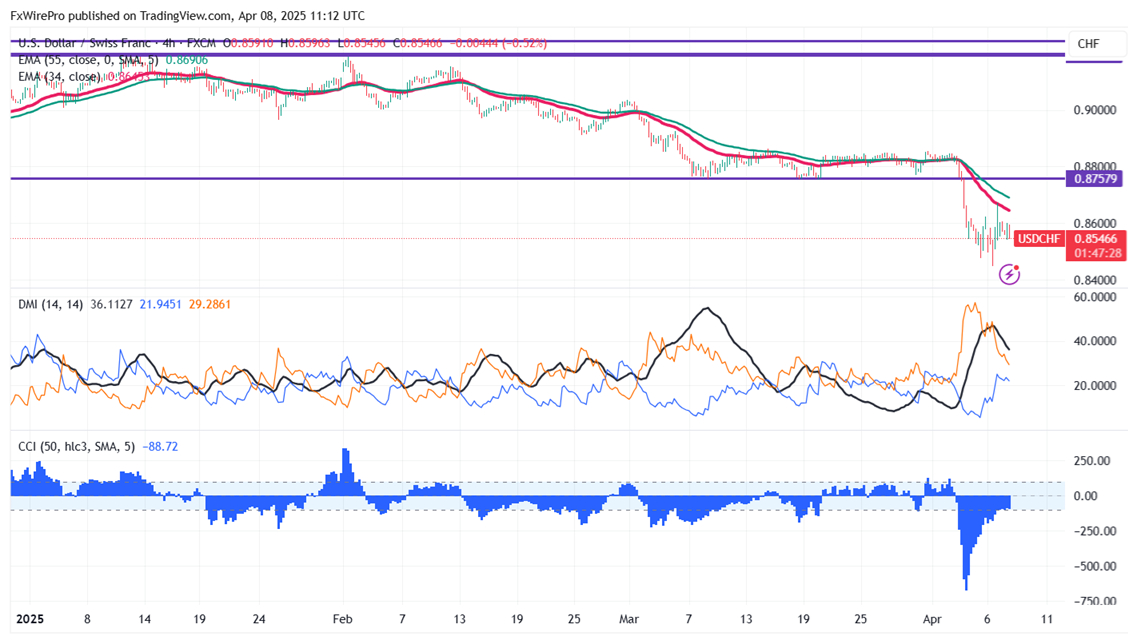

The currency pair is consolidating after forming a minor bottom around 0.8450. It hits an high of 0.86727 and is currently trading around 0.85507. The intraday bias appears to be bearish as long as the resistance 0.8757 (support turned ito resistance ) holds.

Technical Analysis Points to Further Downside

The pair is trading below the 34-EMA and below 55-EMA on the 4-hour chart indicates a minor up trend. The immediate resistance is at 0.8620 any break above targets 0.8660/0.8700/ 0.8757/0.8800.

Support Levels and Potential Declines

On the downside, near-term support is around 0.8450, any violation below will drag the pair to 0.8425/0.8375.

Bearish Indicators

CCI (50) - Bearish

Directional movement Index - Bearish

Trading Strategy Recommendation

It is good to sell on rallies around 0.8660 with a stop-loss at 0.8760 for a TP of 0.8425