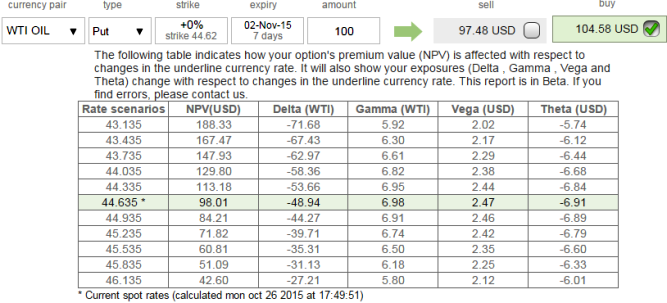

Let's suppose, as shown in the diagram, we have vega of at the money WTI put option at 2.47 with implied volatility at 20% which is now trading at US$104.38.

This would mean that the chances of upside risks of option prices to reduce by US$49.4 if the underlying commodity price rallies and the other way round.

Option premiums behave with this reasoning, vertical bear put spread strategy is employed when the options trader thinks that the price of the underlying WTI crude will fall reasonably in the near term but within a bracket of 3% downward range.

Rationale: Always remember the option's delta and vega would have the huge impact on a long put position should the market bounce.

So the recommendation would be "long vertical put spread" that will cuts down the exposure you have against dubious rallies in anyone's mind, but more significantly it will also reduce the exposure you have to Vega, the relative effects of volatility on the option prices.

One way of minimizing the avid appetite with a naked long put has for your precious capital is to spread much of the risk by using vertical spreads.

Hence, we constructed the above strategy by shorting (-3%) deep Out-Of-The-Money put with the same maturity so as to turn vega into correspondingly positive.

FxWirePro: Vertical spread to reduce WTI vega risks

Monday, October 26, 2015 12:39 PM UTC

Editor's Picks

- Market Data

Most Popular