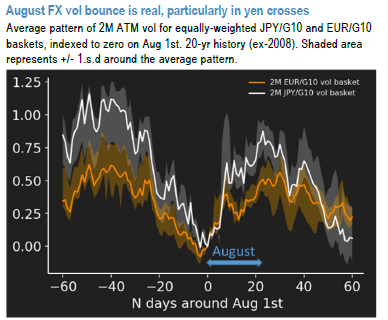

August FX vol bounce is real, particularly in yen crosses but monthly vol rallies tend to be only of the order of 1vol. This relatively benign outcome leaves us comfortable with carrying short skews as a core theta-earning alpha theme. USDJPY projection has been lowered as we expect dollar weakness to prolong. And while the Japanese leadership is worried about the continued strength of the yen, they are unlikely to have much to say against it.

Summer (il-)liquidity is fertile ground for FX vol shocks, and has already been experienced to some extent in recent days. Last week, we showed that VXY Global tends to exhibit a seasonal August vol bounce 75% of time; that number rises even further for JPY- and EUR- cross vols. Refer 1st chart that runs us through a closer look at the pattern of 2M ATM vols in JPY/G10 and EUR/G10 crosses (equally-weighted baskets) around August over the past 20-years. Since 3M expiry vols today are inflated on account of event risk premium for the upcoming US election in November, we limit the historical seasonality analysis to 2M implieds instead, though the conclusions are virtually identical. We find vol bounces to be surprisingly regular, displaying 100% consistency across both currency baskets. Magnitudes are moderate however; even for high-beta JPY crosses, monthly vol rallies tend to be only of the order of 1vol (vs.0.5pts for EUR). This relatively benign outcome leaves us comfortable with carrying short skews as a core theta-earning alpha theme for the vol model portfolio.

One of our higher conviction expressions of the short skew theme is in USDJPY, where risk-reversals have been inflated by stepped up hedging of US investments now that the DXY is in decline and cost of hedging has fallen precipitously following Fed rate cuts earlier in the year. This position has taken some pain of late on account of the sharp spot collapse to 105 driven by what our macro strategists have characterized as a Japanese holiday driven air pocket of yen buying without offsetting residents’ overseas bond purchases. 2nd chart shows this has caused realized spot-vol correlation in USDJPY to spike of late.

We reckon this is due a correction as normal GPIF service has resumed, helped perhaps (hopefully?) by the dollar selloff taking a breather after a breakneck July. One way of getting exposure to that USDJPY skew normalization in with some defensive cover is via an AUDJPY vs USDJPY risk-reversal spread. The current riskie spread at 0.5 vols is almost back to pre-COVID-19 historical lows (refer 3rd chart) courtesy the near 100% retracement of AUDJPY skews from the highs. Admittedly, despite the current pricing levels there is a risk from x-yen riskies underperformance continuing to outpace USDJPY riskies. Courtesy: JPM

Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand