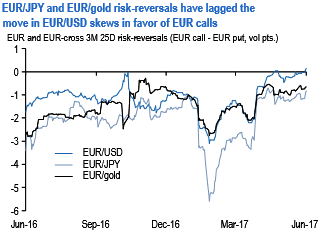

Please be noted that the IVs of EURJPY is spiking highest among G10 FX space and risk reversals have been indicating bearish risks in short run and has been neutral in the long run. A Risk Reversal is an individually tailored hedging solution, structured to meet your needs.

The steepness of the EURJPY risk-reversal curve renders back-end tenors better shorts, however, we prefer sticking to 2017 expiries (6M) since 2018 dates come with unpredictable Italian election risk.

The hedge rate is less favorable (if unleveraged) compared to the Outright Forward rate. The hedge rate applies only to a part of the exposure due to the use of leverage (Leveraged Risk Reversal). The structure might have a negative market value during the lifetime and may involve costs if you want to close the position prior to expiry date.

The EUR/gold risk-reversal curve is much flatter in comparison hence short tenors work fine. We enter short 6M 25D EURJPY risk-reversals (delta-hedged).

this week in sub-3M expiries in response to Euro strength, but there are still two laggards among Euro-crosses that are bid for EUR puts and have room to play catch-up (refer above chart) if Euro strength continues: EURJPY (3M 25D r/r -0.8mid) and EUR/gold (3M 25D r/r -0.65 mid).

Spot-vol correlation performed strongly positively this week and supports a narrowing of the EUR call discount: a 2.9% rally in EURJPY was accompanied by a 0.85 %pt. jump in 3M ATM, while a 2.5% rally in EUR/gold led to a +0.4 vol uptick.

The obvious appeal of EUR-cross skews is that they earn smile decay while waiting for a re-pricing; they also avoid exposure to a Fed-driven bounce in the dollar, which isn’t looking much of a problem at the moment but has a low bar for resurfacing given the dollar’s substantial rates/FX disconnect and extended duration length in Treasuries.

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures