In this write-up, we run you through the DBS bank’s perceptive views on rate yields outlook in one emerging market in comparison with USTs.

The Central Bank of Malaysia maintained the status quo in its monetary policy, keeping benchmark interest rate unchanged at 3.25 percent on January 24th, 2019, as widely expected. Policymakers that the decision in consistent with the intended policy stance and they will continue to monitor the balance of risks surrounding the inflation and domestic growth outlook. The Committee also noted that the economy maintains its underlying fundamental strength, with steady economic growth, low unemployment, and a current account surplus.

Well, with growth outlook biased to the downside and inflationary pressures likely to stay benign, we expect Bank Negara Malaysia (BNM) to keep policy rates unchanged today (decision expected today at 3pm) and rest of the year. IRS markets are largely in line though pricing has recently moved from small chance of 1 hike to small chance of 1 cut.

Based on several valuation metrics, Malaysian Government Securities (MGS) look cheap. Real yields on 10Y bonds are elevated at 4.0% vs the long-term range of 1.0 - 2.5%. 10Y spread over US Treasury has surged to 130bps, high compared to other similarly-rated sovereign credits such as Poland (11bps) and Thailand (-30bps).

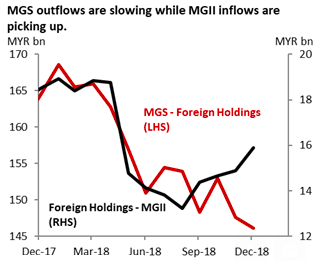

We recognize that some of the cheapness should be attributed to weaker fundamentals. Malaysia's fiscal position has worsened post-elections and reforms could take some years to complete. However, in our view, the government’s reform plans are credible and the risk of rating downgrades remains low (Moody’s recently reaffirmed Malaysia’s rating at "A3" and kept outlook "stable"). Looking at technicals, the pace of outflows from MGSs is slowing and Malaysia Government Investment Issues (MGII) are seeing healthy inflows lately. Positioning is probably light after 2018’s outflows and we could see some yield compression when inflows return. All considered MGSs are cheap even after accounting for the weaker fundamentals.

On a currency-hedged basis, MGS yields have turned very attractive. MGS-UST yield differentials have widened and the cost of hedging has declined. Courtesy: DBS & Bloomberg

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -73 levels (which is bearish) while articulating (at 10:30 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics