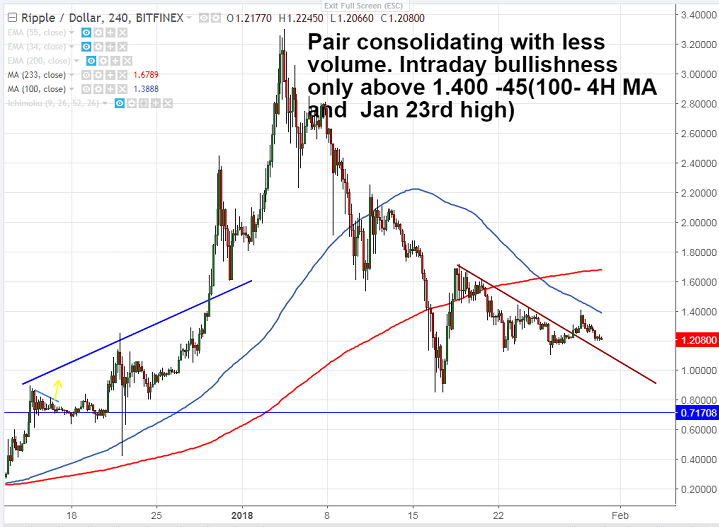

- XRP/USD was consolidating in narrow range after forming a minor bottom around 1.150 level. The pair started to decline after from that level. It is currently trading around 1.200

. - Ripple hits high of 1.4390 on Jan 23rd 2018 high and declined from that level. The near term resistance 1.4500 and minor bullish confirmation can be seen above 1.45 level. Any violation above 1.45 targets 1.60 (support turned into resistance)/1.725-1.75.

- XRPUSD should close above 1.7245-1.75 (61.8% retracement 2.25 and 0.87) for further bullishness. Major resistance at 2.25 high made on Jan 11th 2018 and break above targets 3/3.31. Overall bullish continuation above 3.31 (Jan 4th 2018).

- In the 4 hour chart, MACD is showing a buy signal but it is trading well below short term (55- 4H EMA at 1.3379) and long term (233-4H MA at 1.700). RSI is trading near 50 and showing upside.

- On the lower side, near term support is around 1.15 and any break below targets 1.13/1/0.87. Major weakness below 0.87.

It is good to stay away from market till breakout happens