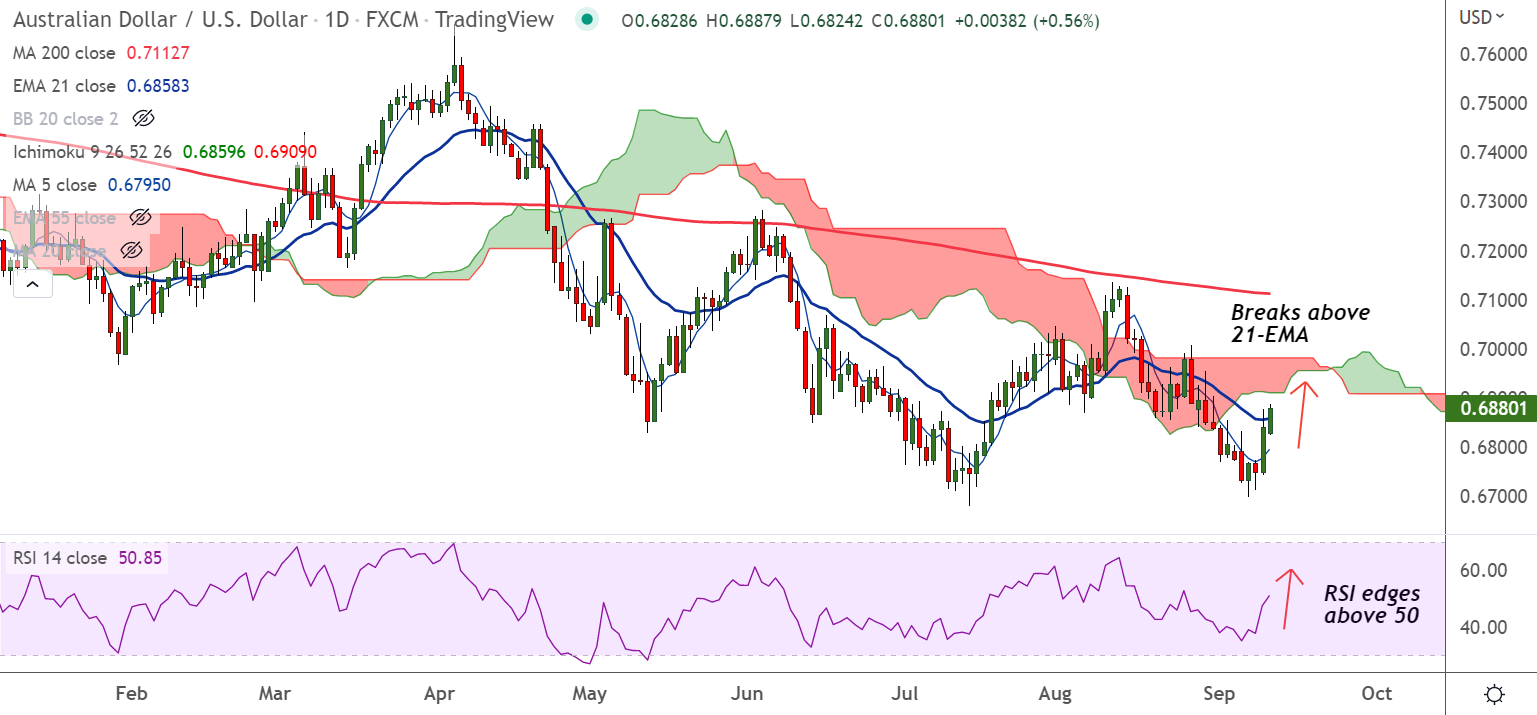

Chart - Courtesy Trading View

AUD/USD was trading 0.29% higher on the day at 0.6859 at around 10:15 GMT.

The pair is extending previous session's spike and has broken above 21-EMA resistance.

Stochs and RSI are biased higher and Stochs are showing a bullish rollover from oversold levels.

ADX supports upside and MACD is on verge of bullish rollover on signal line.

Price action has broken above 200H MA and GMMA indicator shows major and minor trend have turned bullish on the intraday charts.

Data Watch:

Australia employment data - Unemployment Rate is expected to remain stable at 3.4%. Employment Change is seen extremely higher at 50k against job cuts of 40.9k.

US Consumer Price Index - Headline CPI is seen at 8.1%, lower than the prior release of 8.5%. Core CPI is seen higher at 6% by 10 basis points (bps).

Support levels - 0.6857 (21-EMA), 0.6795 (200H MA)

Resistance levels - 0.6914 (55-EMA), 0.6991 (110-EMA)

Summary: AUD/USD poised for further upside. Close above 21-EMA will fuel further gains. Bulls eye 55-EMA at 0.6914.