Before we emphasize anything much on this write-up, we urge you to go through our previous post this pair which is available on below website:

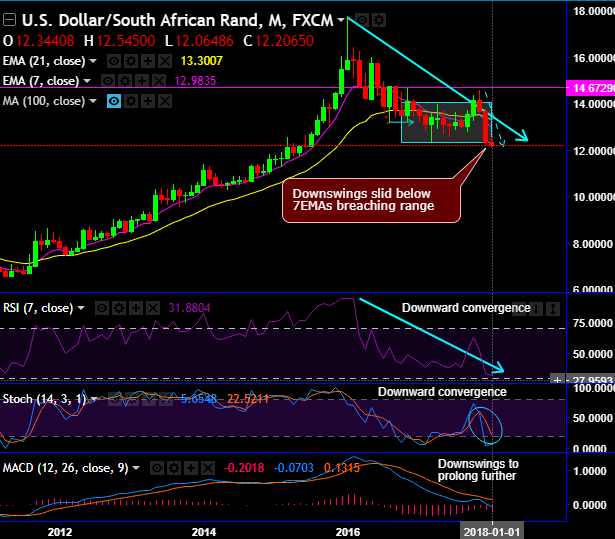

Well, shorting strangle options strategy was advocated about a fortnight ago, USDZAR is the recommended pair to sell DNTs in early January when the political noise was published; the above chart explicitly shows that the underlying spot FX convincingly breached its barriers over the advised period. Thereby, desired yields are certain by the way of initial premiums received.

While the South African central bank (SARB) assumed a cautious wait and see approach yesterday as expected. It left its key rate stable at 6.75% and adjusted its inflation outlook to the downside. The reason behind the latter was the stronger rand.

As expected it remained cautious when adjusting the rate outlook for 2018 and 2019 due to the risks for the rand and continued to signal a little less than two rate hikes until year-end 2019.

It stressed in its statement that the rand will remain susceptible to political uncertainty. It explicitly referred to Moody’s decision on a rating downgrade that will be taken following the presentation of the budget on 21st February. It was interesting to see that at 5:1 the rate decision was not unanimous: one member voted for a rate cut.

The news had hardly any effect on the rand, like other EM currencies it benefitted from continued USD weakness. We remain skeptical and urge investors to be cautious not least due to the continued political risks.

On hedging grounds, we would like to maintain shorts in USDZAR (post-February 2018 budget announcement) by buying 3m ATM -0.49 delta put options with a view to arresting downside risks.

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays