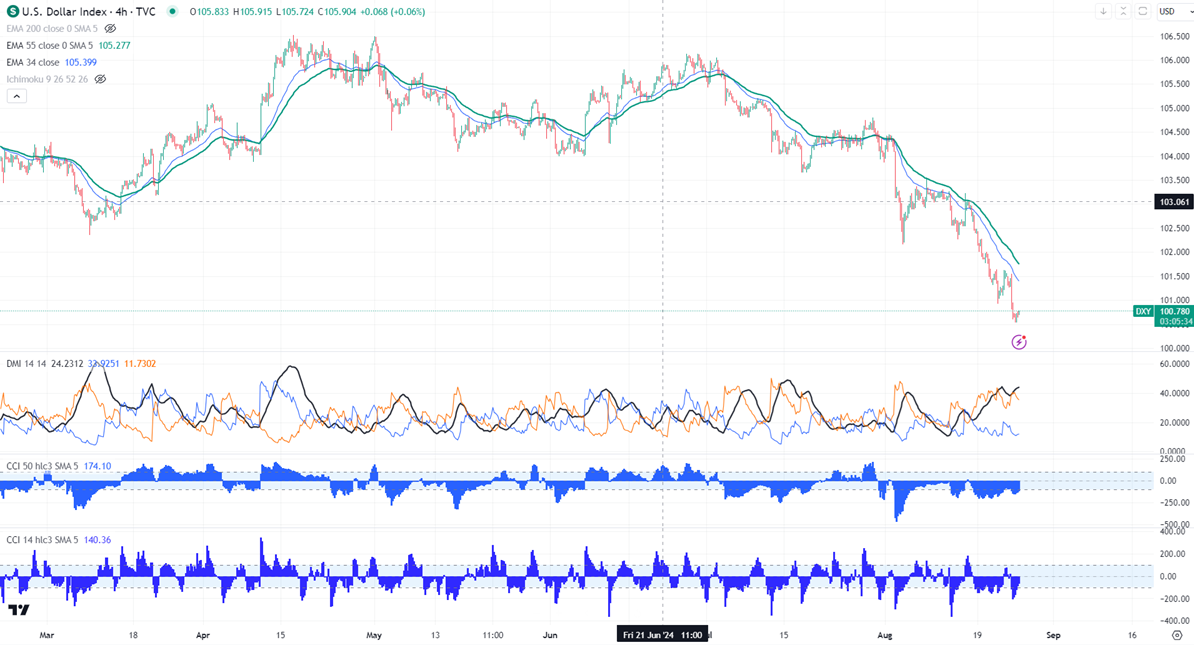

Major support- 100

Major resistance- 102

DXY showed a minor sell-off after the Fed Chairman's speech at the Jackson Hole symposium. It hit a low of 100.54 and is currently trading around 100.73.

Powell stated “The upside risks to inflation have diminished. And the downside risks to employment have increased,” He said “The time has come for policy to adjust,”

According to the CME Fed watch tool, the probability of a 50 bpbs rate cut in Sep increased to 38.50% from 24% a week ago.

On the lower side, near-term support is around 100.60 and the violation below will drag the index down to 100/99.57/99/98. Significant resistance is around 101.20, and breach above targets is 101.60/102. Overall bearish invalidation bearish invalidation only above 103.

Indicators ( 4- hour chart)

Directional movement index - Bearish

CCI (50)- Bearish

CCI(14)- Bearish

It is good to sell on rallies around 101.20 with SL around 102 for a TP of 99.57/98..