The EUR/JPY trades flat after a slightly dovish rate cut by the ECB. It hit a low of 161.83 yesterday and is currently trading around 162.44.

Intraday bias remains neutral as long as resistance 163.89 holds. The pair remained within a narrow range of 163.61 and 162 for the past week.

European Central Bank (ECB) cut its deposit rate by 25 basis points, which was anticipated. In the press conference, ECB President Christine Lagarde emphasized that the bank is not committed to a specific trajectory for future rates and remains cautious, data data-dependent.

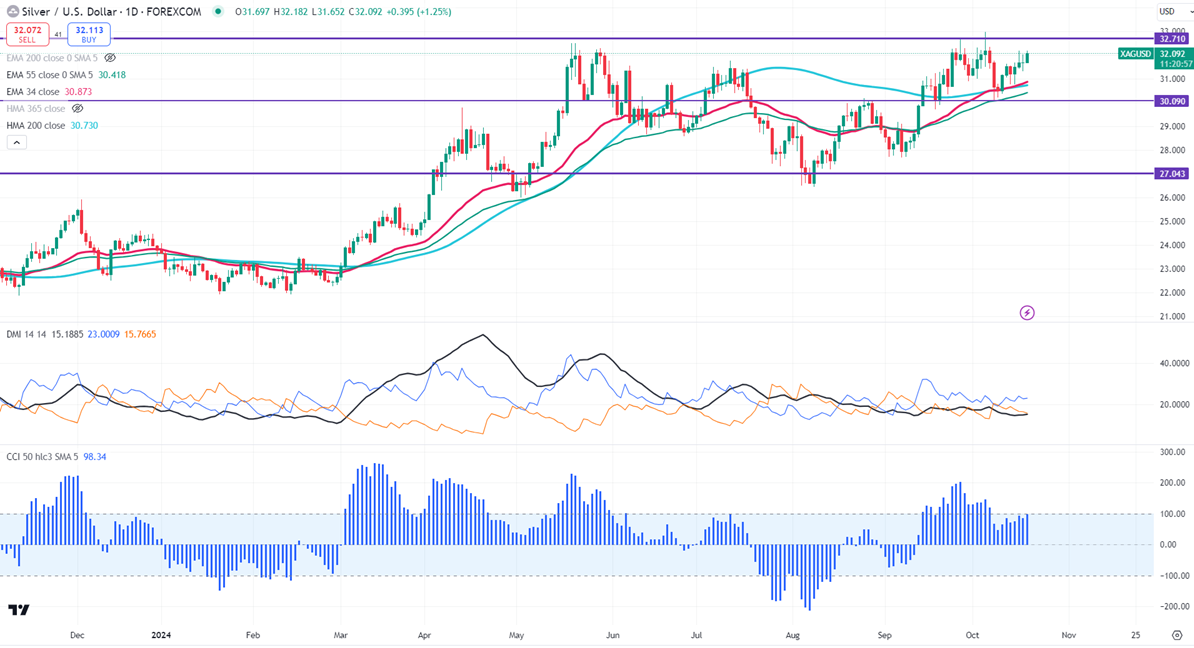

Technicals-

The pair is trading below 34- and above 55 EMA and 365 hull moving average in the 4-hour chart.

The near-term resistance is around 163, a breach above targets 163.60/163.89/164.64/165/167.37 (61.8% fib retracement level from 175.41 and 154.40) The immediate support is at 161.90, any violation below will drag the pair to 161.20/160.65/160/159/158.35.

Indicator (4-hour chart)

CCI (50)- Bearish

Average directional movement Index - Bearish. All indicators confirm a bearish trend.

It is good to buy on dips around 162-162.05 with SL around 161.40 for a TP of 163.60.