Nikkei 225 -

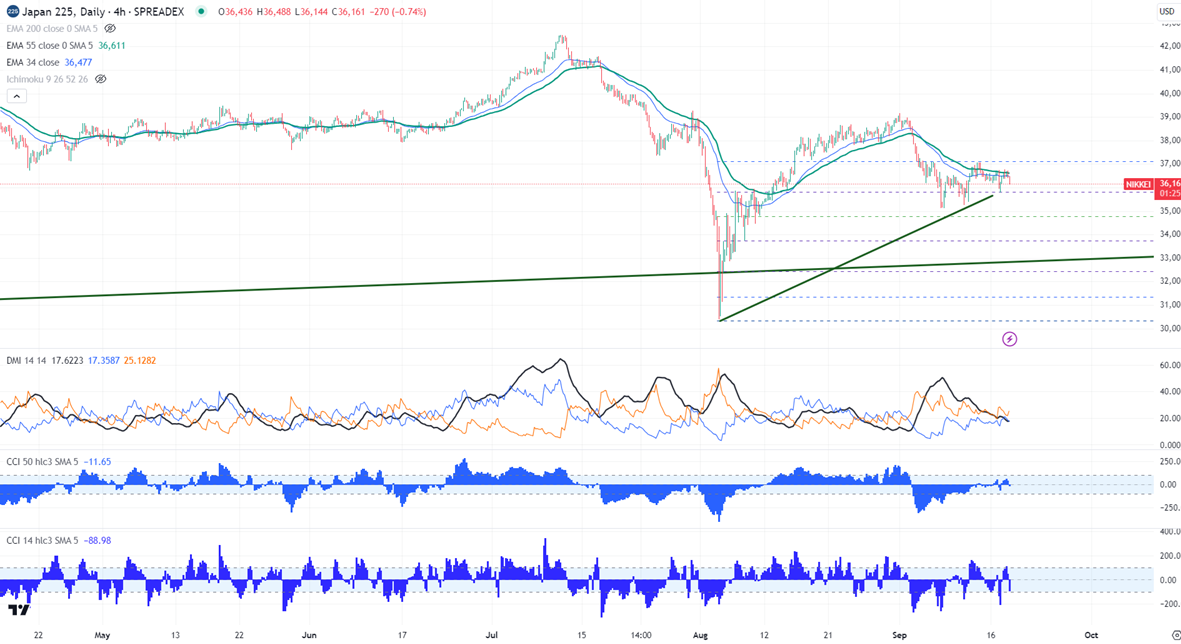

Nikkei trades flat ahead of Fed monetary policy. It hit a high of 37718 at the time of writing and is currently trading around 36451.

Markets expect a 25 bpbs rate cut by Fed. Any hawkish rate cut will drag the index down to 35000.

The index holds below short term 34 and above 55 EMA and below the long-term moving average (200- EMA) in 4-hour chart.

The near-term resistance is around 37147, any violation above will take the index to 37500/37695/38000. Overall bullish continuation only above 42550.

On the lower side, immediate support stands around 36360, any breach below will drag the index down to 36175/36000/35870.Further bearishness is only below 35000.

Indicator (4- hour chart)

CCI (14)- Bullish

CCI (50)- Bullish

Average directional movement Index - Neutral

It is good to sell on rallies around 36980-37000 with SL around 37500 for TP of 35000.