The GBP/JPY pair is consolidating after hitting a multi mThe GBP/JPY pair is currently in a consolidation phase after reaching a multi-month high of 198.44, driven by a strong yen. The pair has since eased back to trade around 197.12.

Recent price movements indicate that GBP/JPY is struggling to hold above 196, but the intraday sentiment remains optimistic for now. Market participants are looking forward to comments from BOE Governor Bailey, which could impact future price movements.

Technical Overview:

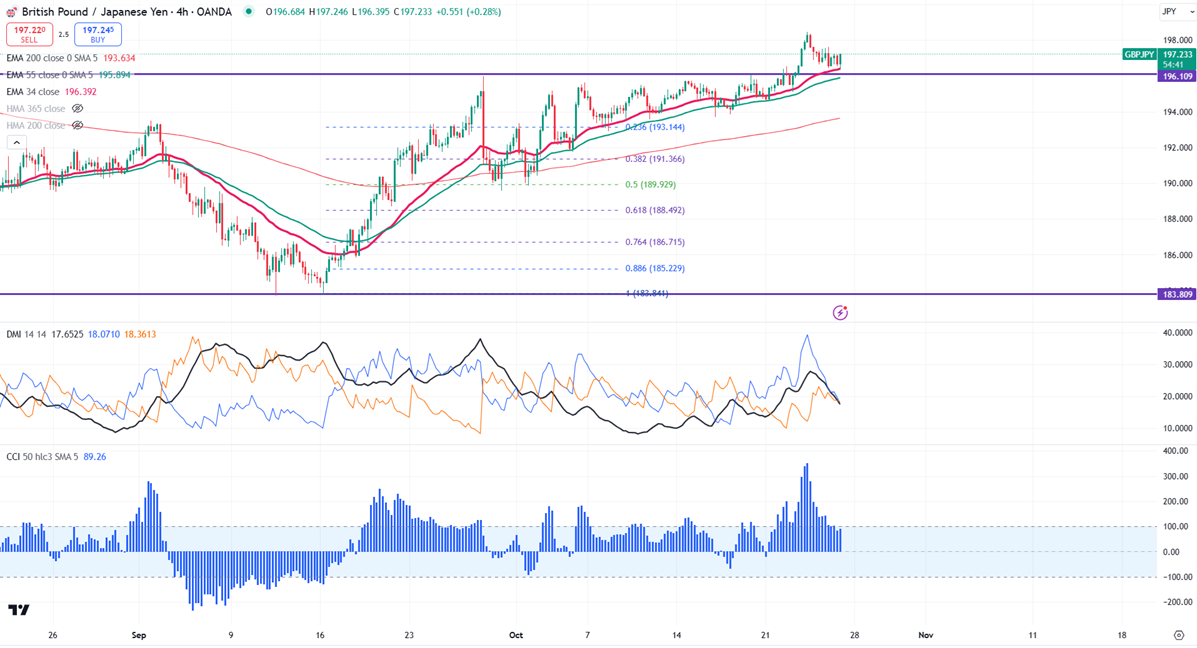

The GBP/JPY pair is currently positioned above the short-term 34 EMA, the 55 EMA (195.04 and 194.78), and the long-term 365 Hull MA (194.87) on a 4-hour chart. Immediate resistance is seen around 196.05; a breakout above this level may confirm a continuation of the upward trend. There is potential for further rises toward 197.37 (161.8% Fibonacci level), 198, and even reaching 200. On the downside, immediate support is found at 195.40; if the pair drops below this level, it could fall to 195, 194.50, 194, 193.70, or 192.50.

Indicator Analysis (4-hour chart):

- CCI (50): Bullish

- ADX: Bullish

All indicators point to a general bullish trend.

Trading Recommendation:

It may be wise to consider buying on dips around 196, with a stop loss set around 195.40, aiming to take profit levels at 197.37 or 198.