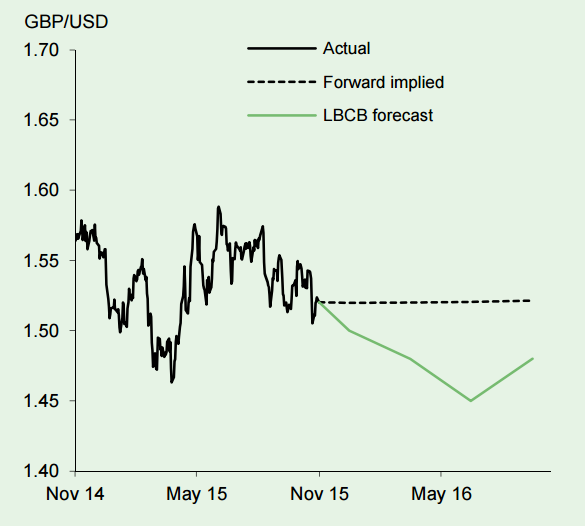

The ratcheting up of US rate rise expectations and more dovish policy signals in the UK have pulled cable down from the mid to low 1.50s. While the US now looks poised to raise rates next month, the tone of the BoE's latest Inflation Report was unambiguously dovish.

The recent developments in the US may argue for the BoE moving earlier, but the BoE's recent rhetoric suggests the strength of the pound, international uncertainties and the weak inflation backdrop argue against. Although the market is largely priced to a rise in US interest rates next month, the crystallisation of this risk is likely to see GBP/USD coming under further pressure - particularly if the Chancellor underscores his commitment to fiscal austerity in his Autumn Statement (on 25th November).

"We target a break below 1.50 over the coming months, with delayed UK monetary policy tightening, fiscal prudence and the potential build-up of EU referendum uncertainty adding to the downside risks in the first half of 2016", notes Lloyds Bank.

GBP/USD Outlook

Tuesday, November 17, 2015 10:30 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX