Economic dockets in past few weeks have been providing plenty of reasons from European Central bank (ECB) to act if it wants to. Growth and inflation slowed in Germany, Spain struggling to get out of deflationary pressure, Greece has fallen back to deflationary territory as per latest January CPI, and monetary conditions have become tighter in some economies like Portugal and Spain.

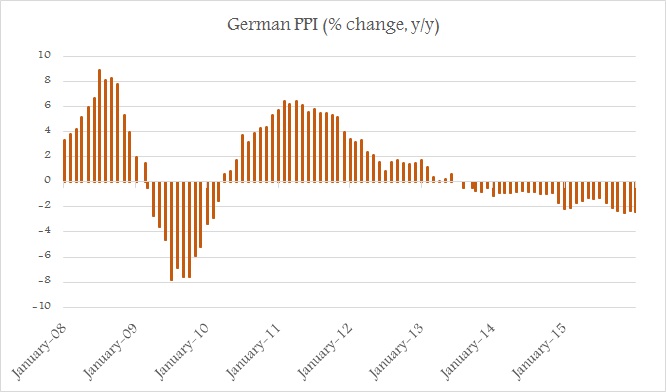

Today German producer price index, provided ECB another reason to act. Producer price index is considered as key indicator for medium term price pressure. German producer prices in January dropped by -2.4% from levels seen a year ago. Energy still contributed largely, with 7.3% decline. Monthly PPI contracted by -0.7%, shattering hopes of 0.3% gain as estimated.

We have recently raised a concern that German economy is Europe's largest and strongest, unemployment rate is at record low of 4.5%, despite so, the demand driven inflationary pressure has been minimal.

However, it is also important to note that, oil price has started declining from mid-2014, or about 18-20 months' back but German PPI with today's data release has contracted for 30th consecutive month.

ECB need to clearly communicate, what is its plan to fight deflationary pressure and reach its mandate of below but close to 2% inflation.

Next ECB meeting is scheduled on March 10th.

Euro is consolidating around 1.11 area against Dollar.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022