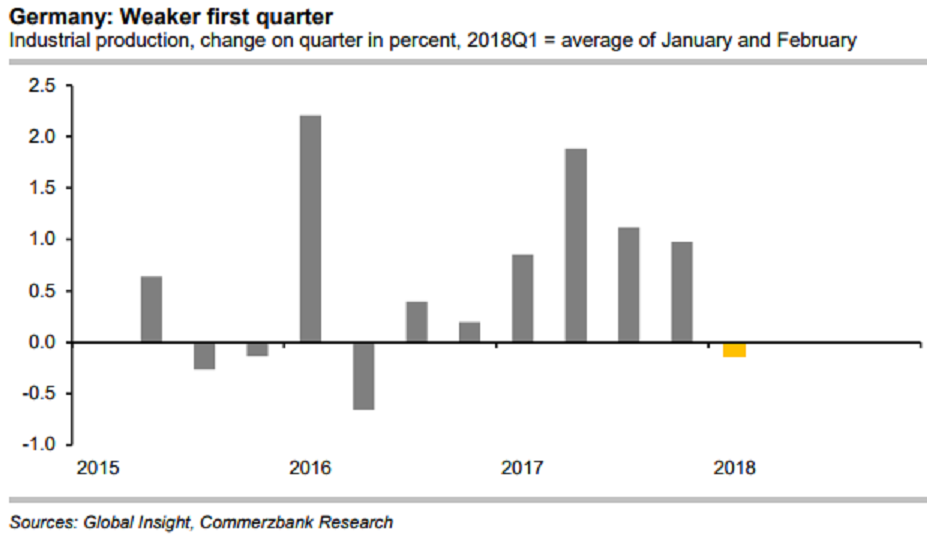

Germany’s industrial production for the month of February disappointed consensus expectations. This means that there are at best signs of a slight increase in production in the first quarter, after several quarters of very significant growth. As a result, the economy as a whole is also likely to have grown less than in the course of 2017, according to the latest report from Commerzbank.

As already indicated by the figures for car production, industrial production fell significantly by 1.6 percent in February compared with the previous month, while the consensus had even expected a slight increase.

In March, production in manufacturing is likely to increase again. However, as construction output is expected to have suffered from the cold weather, industrial production (i.e. manufacturing, construction and power generation) may have increased slightly at best in the first quarter. This would be a significantly slower pace than in previous quarters. As a result, the economy as a whole is also expected to grow less than before in the first three months.

"On the basis of the figures available to date, we expect real GDP to have grown by only 1/2 percent compared with the previous quarter, after growth rates between 0.6 percent and 0.9 percent last year. The recently weaker order intake and falling leading indicators lead us to expect a lower dynamic in the coming quarters as well," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom