So far the current recovery has not helped the banking sector as a whole. The average stock price levels of global banks remain much below than their pre-crisis level.

Why?

- Banks are hit by increased provisions over misconduct during 2008 crisis. They remained flocked by regulators over Libor scandal, currency fix manipulation, Mortgage back securities issuance and recommendation. Further pressure came from scrutinizing their role over tax avoidance, money laundering and black money.

- Even secretive Swiss banks are not able to escape this regulatory wrath.

- Moreover, BASEL III regulations and tougher rules through MIFID-II in Europe and Dodd Frank in US have taken toll on capital requirements.

- Lower interest rates, provided cheaper finance but reduced the margin of lending.

Good news -

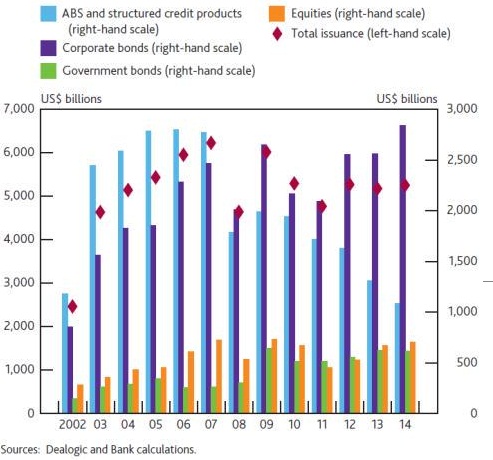

- Recent data compiled by Dealogic shows that Global Investment banks helped in issuing securities in the tune of $ 5.2 trillion in 2014, close to pre-crisis level.

- Corporate bond issuances were higher than pre crisis level close to $ 2.8 trillion.

- Equity issuance reached to levels close to pre-crisis.

- Governments have increased their share above $ 500 billion.

- Nevertheless, due to regulation and persistent weakness issuance of asset backed securities fell to just above $ 1 trillion compared to pre-crisis high of $ 2.7 trillion.

Banking stocks might do better as green shoots of growth are appearing in US and across Europe as they still remain cheaper across globe.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings