- The yellow metal edged higher and made high of $1239 yesterday.

- Gold was benefited from the lower US markets, DJIA closed down -40.4 pts or -0.25% and S&P 500 closed down -8.99 pts, -0.47%.

- Today pair made intraday high at $1232 and low at $1224 levels.

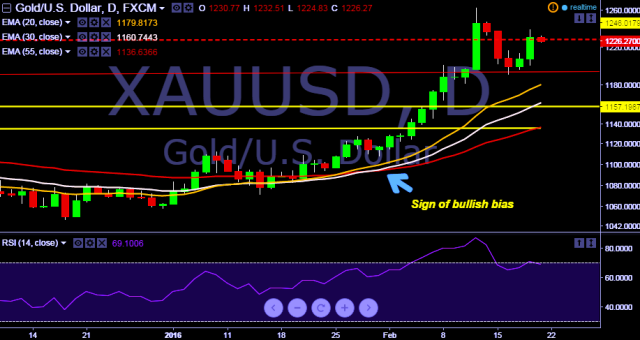

- Intraday bias remains bullish till the time pair holds key support level at $1195 marks.

- On the top side, a daily close above $1239 will drag the parity towards $1268, 1292 and $1300 thereafter.

- Alternatively, key support levels are seen at $1222, $1218 and $1208 thereafter.

- Later today, US will publish inflation data. Analysts are projecting the consumer price index to fall 0.1% in January, on top of a similar-sized decline in December.

We prefer to take long position in XAU/USD around $1223, stop loss $1218 and target $1252 levels.