Previously we, at FxWirePro fundamental has been arguing that European Central Bank (ECB) will have to do more and can do more and the basis of our arguments have been higher unemployment, which is not conducive to growth and inflation that the central bank is looking for desperately. With large section of the population, 10.3% to be precise, remaining out of job, it is difficult to achieve a demand driven inflation, which will be sustainable, unlike lower exchange rate driven one.

While we, believe, ECB may be nearing its easing limit, it is likely to hold policy for much longer than currently anticipated. It is very much likely to be another 3-4 years, probably more than that, when ECB can finally starts raising rates, without serious consequences over growth and basis of our arguments is higher non-performing assets (NPA/NPL) across Euro Zone banks.

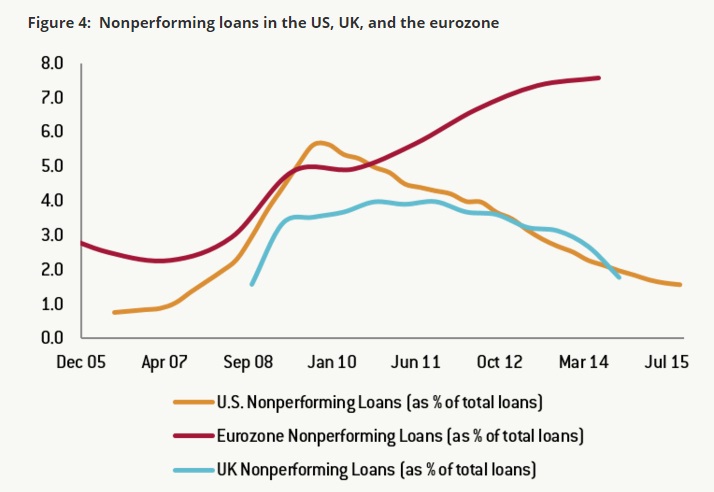

The chart, which we acquired from Bruegel, best explains the argument. You can check out the article at Brugel here, http://bruegel.org/2016/04/mere-criticism-of-the-ecb-is-no-solution/ , which is quite detailed on Euro Zone’s hurdles.

After the financial crisis of 2008/09, non-performing loans shot up across developed world. By later 2009, NPLs at U.S. banks crossed both that of Euro Zone and UK and was closer to 6%. NPLs were best contained in UK around 4%. While both of these economies have taken significant steps and reduced their NPLs to almost pre-crisis level, NPLs have crept up around 7% across Euro Zone.

Such fragility demands strengthening of banks’ balance sheet, which will not be easy to do, given the political structure in Euro Zone and austerities. Moreover, unified banking system and ECB’s single supervisory mechanism which was adopted in response to 2011/12 Euro Zone debt crisis are still quite far from being implemented.

This basically means, Euro Zone will stay in ECB’s intensive care for much longer.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022