Hong Kong’s labor force is projected to plateau in 2019-2022 and decline thereafter. With the gap between labor demand and supply widening, jobless rates will continue to stay at low levels irrespective to the economic cycle, according to the latest government report.

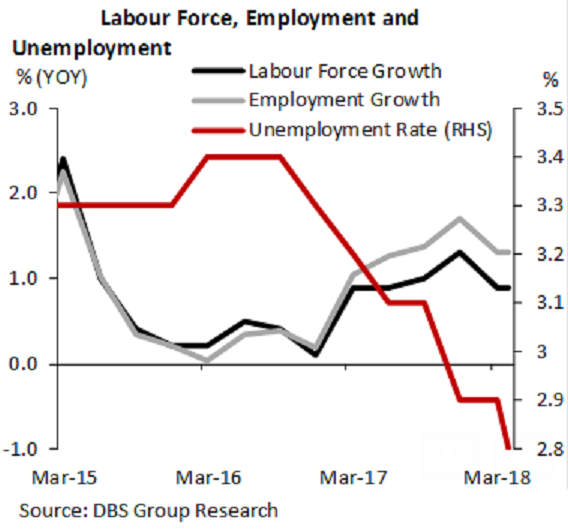

The labor market has tightened further in February-April 2018 on the back of strong economic conditions. Real GDP grew by 4.7 percent y/y in Q1 2018, above its 10-year trend growth of 2.7 percent. In turn, the unemployment and underemployment rates fell to 20-year lows of 2.8 percent and 1 percent respectively.

The jobs market has, over the past year, improved in the major services sectors from buoyant asset markets, vibrant trade flows and an ongoing recovery of inbound tourism. The financing sector, trade- and tourism-related segments (which together employ 50 percent of the workforce) posted discernible declines in their jobless rates.

Meanwhile, labor market conditions will likely remain tight in the near term on the back of the robust economic growth momentum. Over the longer term, total employment growth will remain steady (1.3 percent y/y in the latest period). Labour supply growth, on the other hand, is expected to slow in the years ahead due to the aging population, according to the latest report from DBS Group Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility