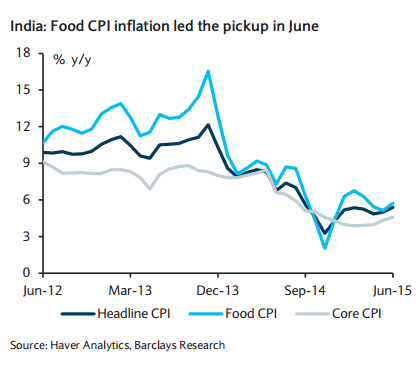

The uptick in retail inflation in June is unlikely to be a major concern for the RBI. India's CPI inflation surprised to the upside at 5.4% y/y in June, up from 5.0% in May and reflecting an increase in the prices of vegetables, pulses and edible oils. Also, prices of petroleum products were hiked in late May-early June, which added to inflation. Excluding food prices (5.7% y/y), underlying inflation remains manageable. Indeed, despite higher service tax in June, core CPI was manageable at 4.6% y/y, up modestly from 4.4% in May.

The inflation trajectory will broadly remain contained, continuing the trend seen in recent months and reflecting a host of factors, including better controls on food prices, persistently idle industrial capacity and a broadly stable INR. Also, oil prices have softened in recent weeks and remain a favorable factor for India. Furthermore, the possibility of a flareup in oil prices appears low. The RBI is expected to remain on course to achieve its early-2016 CPI target of 6%. In the near term, rainfall during the monsoon season is likely to have an influence on food prices and the overall trajectory of retail inflation.

Barclays notes:

- We forecast FY 15-16 average CPI inflation of 5% (H1 FY 15-16: 4.5%, H2 FY 15-16: 5.5%).

- We expect monetary policy in the coming months to remain data dependent.

- Despite the RBI's recent cautious guidance, we still see risks of another cut in H2 15.

However, a potential cut will remain contingent on greater clarity on a number of factors, including trends in commodity prices, the monsoon outcome, the likely 2016 inflation trajectory and the impact of a potential Fed rate hike, possibly in H2 15.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022