Japan's CPI calculation will be revised next year due to a periodical rebasing which is conducted every five years. In the next revision, we may see increased weighting and upward pressure on prices in areas such as electricity costs (especially after the 2011 earthquake disaster) and home renovation costs (imputed rent). Among these items, the discussion on imputed rent costs are especially under focused, as the BoJ has also been focusing on this point. Revision to the calculation of imputed rent could push up CPI as much as 0.2pp, according to the BoJ's study.

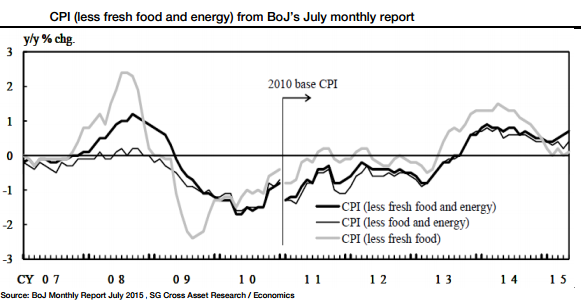

In addition, there are discussions regarding the possibility for changing the BoJ's inflation target from "CPI" to "CPI excluding fresh food and energy". In the BoJ's July Monthly economic report, a chart of "CPI less fresh food and energy" was introduced for the first time. This index indicates stronger inflation than other indices, due to the effect of declining oil prices. As the BoJ's price stability target is a "flexible inflation targeting", the BoJ will continue to look at various economic and monetary conditions.

The 2015 base revision probably will not have much of an effect on the CPI trend and the BoJ's commitment to achieve the 2% price stability target remains intact. This target was determined in a joint statement by the government as well as the BoJ. PM Abe's LDP had committed in the manifesto during the election campaign to a 2% inflation target and this won the confidence of voters. Therefore, it will not be altered in any of the BoJ policy meetings.

Japan: CPI base revision will not alter the inflation trend, BoJ’s 2% target remains intact

Wednesday, August 5, 2015 1:42 AM UTC

Editor's Picks

- Market Data

Most Popular