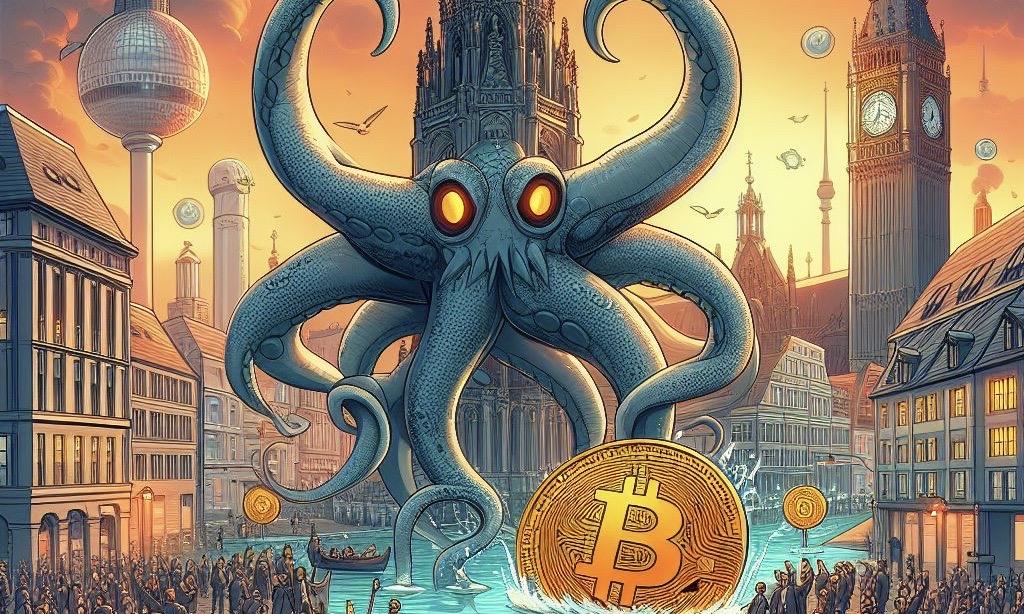

Cryptocurrency giant Kraken makes waves with its strategic decision to launch operations in Germany, a pivotal move in its broader European expansion plan. Teaming up with DLT Finance, a regulated financial institution, Kraken aims to offer tailored crypto solutions to meet the diverse needs of German investors.

Kraken's German Expansion

In a stunning development, Kraken, a worldwide known CEX, recently announced plans to begin operations in Germany as part of its European expansion, Coingape reported. In collaboration with DLT Finance, a regulated financial institute and custodian for digital assets, the CEX intends to provide various innovative crypto products, each adapted to German clients' specific needs and preferences.

This move by the cryptocurrency exchange is an attempt to broaden its global footprint. Let us take a closer look at the company's official announcement.

On May 6, Kraken said that it wants to establish a presence in one of Europe's important markets, Germany, through cooperation with DLT Finance. Furthermore, beginning July 10 of this year, the business plans to present a nationwide stockpile of cryptocurrency-related services.

DLT Finance, a subsidiary of the well-known BaFin-licensed crypto services providers DLT Securities GmbH and DLT Custody GmbH, aims to change the German crypto market.

Once the agreement is operational, DLT Finance will streamline specifically designed skills and infrastructure to meet the demands of millions of Germans and provide secure and compliant crypto services.

Kraken CEO David Ripley commented on the relationship: "Collaborating with industry-leading partners is a critical aspect of our objective to drive the worldwide adoption of cryptocurrency. With over 5% of Germans already owning crypto assets, we are confident in the potential of our innovative product suite." He also stated that "along with excellent local language client service support - will be appealing to prospective clients as crypto continues to become more mainstream across Europe."

Strategic Partnership

As reported by CoinGape Media earlier this year, Kraken even obtained a Virtual Asset Service Provider (VASP) registration from the Dutch Central Bank. This is consistent with CEX's European expansion objectives, as the company now has legal rights to offer its top-tier crypto services to Dutch residents.

Meanwhile, this story appears to have fueled the global rivalry between recognized cryptocurrency exchanges.

Photo: Microsoft Bing

OpenAI Targets $600B Compute Spend as IPO Valuation Could Reach $1 Trillion

OpenAI Targets $600B Compute Spend as IPO Valuation Could Reach $1 Trillion  Anthropic Resists Pentagon Pressure Over Military AI Restrictions

Anthropic Resists Pentagon Pressure Over Military AI Restrictions  xAI’s Grok Secures Pentagon Deal for Classified Military AI Systems Amid Anthropic Dispute

xAI’s Grok Secures Pentagon Deal for Classified Military AI Systems Amid Anthropic Dispute  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology

Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Hyundai Motor Plans Multibillion-Dollar Investment in Robotics, AI and Hydrogen in South Korea

Hyundai Motor Plans Multibillion-Dollar Investment in Robotics, AI and Hydrogen in South Korea  Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize  Bitcoin Crashes Below $65K: Bears in Full Control, Sell Rallies Now

Bitcoin Crashes Below $65K: Bears in Full Control, Sell Rallies Now  Nvidia Earnings Preview: AI Growth Outlook Remains Strong Beyond 2026

Nvidia Earnings Preview: AI Growth Outlook Remains Strong Beyond 2026  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  Samsung Stock Hits Record High on Nvidia HBM4 Supply Deal, Boosting AI Chip Rally

Samsung Stock Hits Record High on Nvidia HBM4 Supply Deal, Boosting AI Chip Rally  Nintendo Share Sale: MUFG and Bank of Kyoto to Sell Stakes in Strategic Unwinding

Nintendo Share Sale: MUFG and Bank of Kyoto to Sell Stakes in Strategic Unwinding  Federal Judge Blocks Virginia Social Media Age Verification Law Over First Amendment Concerns

Federal Judge Blocks Virginia Social Media Age Verification Law Over First Amendment Concerns