CFTC commitment of traders report was released on Friday (12th January) and cover positions up to Tuesday (9th January). COT report is not a complete presenter of entire market positions; however, it represents a good chunk of institutional traders, to have a feel of what expected by the big players.

Kindly note, in some cases, numbers are rounded to nearest decimal.

- Gold – Net position long and increasing

Long positions rose for a fourth consecutive week. The net long position increased by 40,020 contracts to +203.3K contracts.

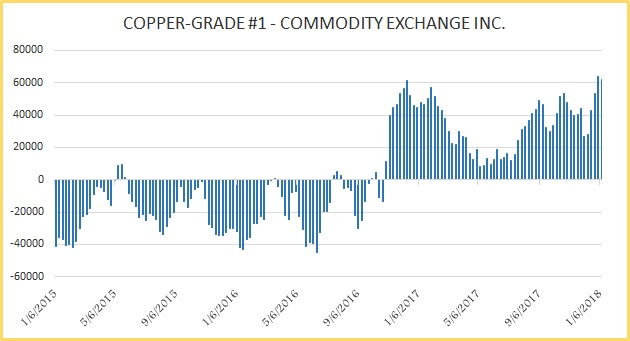

- Copper – Net position long and decreasing

Long positions declined last week. The net longs decreased by 1,628 contracts to +62.3K contracts.

- Silver – Net position long and increasing

Long positions rose for a second straight week. Last week, speculators increased long positions by 15,285 contracts to +38K contracts.

- WTI Crude – Net position long and increasing

Speculators increased long positions last week and by 33,377 contracts, which brought the net positions to +657.6K contracts.

- Natural gas – Net position short and increasing

Short positions declined for a second consecutive last week and by 4,489 contracts that pushed the net position to -136.7K contracts.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022