CFTC commitment of traders report was released on Friday (9th June) and cover positions up to Tuesday (6th June). COT report is not a complete presenter of entire market positions; however, it represents a good chunk of institutional traders, to feel what’s going on in capital markets and how big traders are aligned.

Kindly note, in some cases, numbers are rounded to nearest decimal.

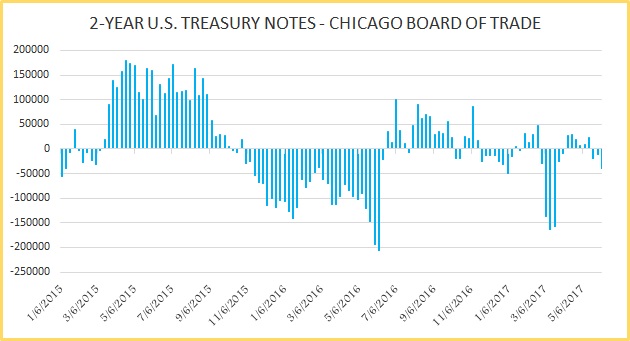

- 2 year U.S. Treasury:

Speculators increased short positions last week. Last week, short positions got increased by 28,319 contracts that led to a net position of -39.3K contracts.

- 5 year U.S. Treasury:

5-year Treasury short positions got increased last week, and by 46,099 contracts that brought the net position to -95.3K contracts.

- 10 year U.S. Treasury:

Speculators covered long position sharply last week. The long positions decreased by 46,099 contracts to +212.1K contracts.

- S&P 500 (E-mini) –

Speculators increased long position for the third consecutive week. The net long positions got increased by 2,377 contracts to +58.5K contracts.

- Russell 2000 –

Short positions got covered sharply last week. The net short positions decreased by 37,354 contracts to -35.7K contracts.

- MSCI Emerging Markets Mini Index –

Long positions increased for the fourth consecutive week and by 9,413 contracts that pushed the net position to +196.3K contracts.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022