CFTC commitment of traders report was released on Friday (1st December) and cover positions up to Tuesday (28th November). COT report is not a complete presenter of entire market positions since the future market is relatively smaller compared to Spot FX market. Nevertheless, it presents a crucial picture of how key participants are looking at future moves.

Key highlights:

Market participants are net long in all currencies against the dollar except the Japanese yen and the Swiss franc.

Shorts increased:

- Short positions in the Swiss franc increased for an eleventh consecutive week and by 444 contracts that pushed the net position to -30.2K contracts.

- Short positions in the New Zealand dollar increased for a fourth consecutive week and by 628 contracts to -14K contracts.

Long positions increased:

- The long positions in the Mexican peso rose for the fourth consecutive week by 9,180 contracts that pushed the net position to +89.6K contracts.

- The long positions in the Canadian dollar rose last week by 533 contracts to +45.7K contracts.

Long positions decreased:

- Long positions in the euro decreased last week and by 5,756 contracts which pushed the net position to +89.7K contracts.

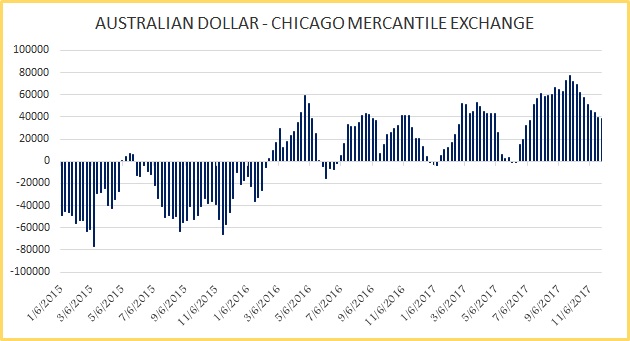

- The long positions in the Australian dollar declined for a ninth consecutive week and by 935 contracts that pushed the net position to +38.9K contracts.

Short positions decreased:

- Short positions in Japanese yen declined for the second consecutive week and by 11,962 contracts to -110.6K contracts.

Position shifted from short to long:

- The long positions in the British pound sterling rose in such a manner that the net position shifted from short to long. Long positions increased by 4,873 contracts to +4.6K contracts.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022