Westpac Research notes:

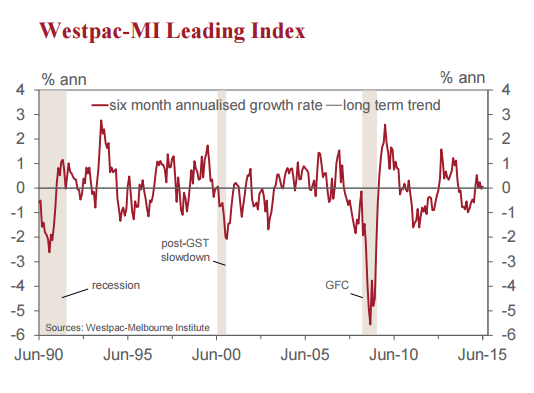

The six month annualised deviation from trend growth rate in the Westpac-Melbourne Institute Leading Index, which indicates the likely pace of economic activity three to nine months in the future, increased from -0.02 % in May to 0.06% in June.

As we noted last month the change in the growth rate of the Index is indicating that the economy appears to be losing momentum through the middle of 2015. In the first four months of 2015 the average growth rate was 0.21% above trend. That was a welcome lift in momentum from the second half of 2014 when the average growth rate was -0.66% below trend. However, in the last two months the growth rate has eased back again averaging only 0.02% above trend.

With the deviation from trend now back to near zero the promising signs that we saw in the early months of 2015 that growth in the economy might be lifting into 'above trend' territory through the second half of 2015 appear to be waning. That profile is certainly in line with Westpac's forecasts that annualised growth pace in the economy will be stuck around 2.5% in both halves of 2015, largely unchanged from the disappointing result in 2014 of around 2.5%.

The disappointment from the apparent lacklustre prints for growth in the Index which we are seeing around mid-year is that a lack of momentum going into 2016 might start to question the generally held view that 2016 will be a better year than 2014 and 2015. For example our own forecasts pitch growth in 2016 at around 3%, up from 2.5% in 2014 and 2015 whereas the Reserve Bank has been bold enough to forecast a lift in growth to 3.25%.

That growth rate of 3.25% is considered to be in the 'above trend' territory and it is likely that the authorities might start to review that optimistic forecast in spite of the expected boost to demand from the falling Australian dollar and record low interest rates.

The Reserve Bank Board next meets on August 4. The Board has demonstrated recently that at these low levels of rates any further cuts will be gradual and most likely timed for the months of February; May; August and November when the Bank revises its forecasts for growth and inflation. Having cut rates in both February and May the August meeting does become a 'live' event.

We expect that it is very unlikely that the Board will decide to cut rates in August. In May it was still forecasting above trend growth in 2016 of 3.25% and we expect that the catalyst for any decision to cut rates would come from a substantial downward revision to its growth forecast for 2016 to 'below trend' territory. That decision will be largely influenced by the assessed momentum in the economy in the second half of this year and developments in the labour market. With insufficient available evidence on the former and, for now, the unemployment rate having stabilised there is almost no case for an August move.

Despite current market expectations we would also put a limited chance of a move in November. In fact we are comfortable to retain the view that rates will remain on hold for the remainder of this year and throughout 2016.

Leading Australian index losing momentum

Wednesday, July 22, 2015 1:03 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed