Litecoin has optimally utilized of its software resemblances with Bitcoin, alongside a more scalable and smaller network, to facilitate the implementation of new developments for Bitcoin and cryptocurrency in general. This way, some of the most important developments in the space has taken place in Litecoin sooner than on any other alt-coin.

eToro, the world’s largest social investing platform, as per their market research on Litecoin,LTC has been more extensively adoptable in terms of total addresses, transactions, and trading volume than some of the other cryptocurrencies, yet the total network value lags in comparison.

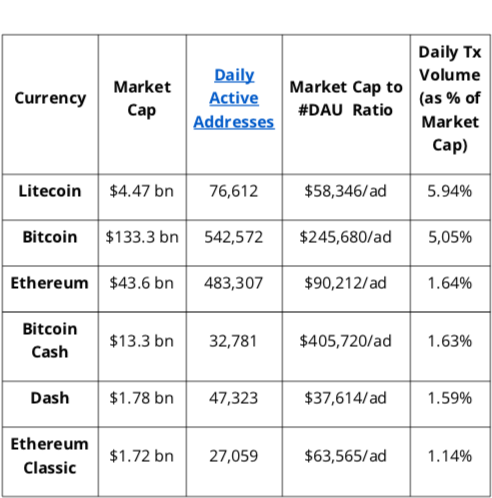

The above table explains as to how theLTC has a much larger number of daily active addresses (DAU) with respect to its market cap than all the other currencies considered (addresses as compared to Bitcoin Cash, and Ether Classicexcept Dash).

Furthermore, the relative daily transaction volume of Litecoinis also larger than that of any other currency analysed, suggesting that it is in fact a very active and established coin which might not be reflected in its current valuation.

Most noticeable aspect is that, LTC has experienced a very significant correction from the all-time highs of the cryptocurrency industry in January 2018.

With respect to its all-time high of $378, LTChas dropped about over 80% to its current price. This is a slightly larger decline than the 71% decline in the total market cap of all crypto assets.

Investment attributes:

Investing or Trading cryptocurrencies would be potentially highly alluring due to its nature of exponential profitability as observed in the recent past, for instance, BTC’s vigorous price rallies in 2017 from the lows of $735 to all the way beyond 19k mark (a mammoth 2600% gains).

On the flip side, it is also perceived as risky venture as the cryptocurrency markets are associated with high degree of volatility and the industry itself is in inception stage, while Litecoin is no exception.

Hence, it is highly imperative to meticulously assess the investment objectives, methodology and level of experience upfront while investing in a new venture. Likewise, it is extremely essential to diversify and contemplate cryptocurrency as an additional element of your portfolio. Given the high risk associated with this class of asset, it is advocated not to allocate more than 20% of the total portfolio into cryptocurrencies. When we say disciplined investment objective during project assessment, thereby, we meant reasonable capital structure, ROI, risk-appetite and timelines need to be set-out pragmatically for better risk reward ratio.

LTCUSD (at BITFINEX) is currently trading at $69.166 levels which is way below 21DMAs with lingering bearish sentiments to prolong in the near-terms. Courtesy: Wachsman

Currency Strength Index: FxWirePro's hourly BTC spot index is inching towards -70 levels (which is bearish), while hourly USD spot index was at 2 (absolutely neutral) while articulating (at 07:35 GMT). For more details on the index, please refer below weblink:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms