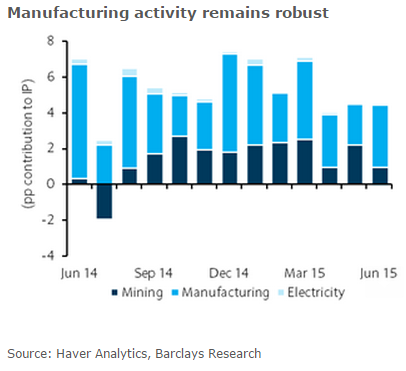

Malaysia's IP came broadly in line with the market expectations at 4.3% in June (May: 4.5%), as activity remains firm after a small dip post GST implementation. On a seasonally adjusted m/m basis, production rose 0.1%, after the jump of 1.5% m/m in May. The IP report corroborates with the surprise increase in exports reported last week, which showed strong momentum in electronic exports. Within IP, growth performance has been most resilient in manufacturing, followed by mining activity. Within manufacturing, the performance of electronics, food products and petrochemicals has been strong.

IP rose 1% q/q in Q2, accelerating from 0.8% q/q sa in Q1. This surprise acceleration comes in the face of GST implementation, which was expected to have a negative impact on production. This bodes well for Q2 GDP figures coming out on Thursday 13 August, where GDP is expected to print 4.9% y/y, higher than 4.5% consensus. This would put the economy comfortably on track to hit the 4.5% growth forecast for 2015, with modest upside risks. Sectors such as palm oil have shown an acceleration in recent months, and private consumption is expected to improve in 2H 2015.

While market conditions in Malaysia have been volatile and the MYR has remained under pressure, growth conditions and real activity have been resilient. BNM was generally cautious in its recent policy statement on global growth, and the central bank is expected to keep rates on hold through 2015, and that it may only look to raise rates by mid-2016.

"We do not think that BNM is likely to undertake any interest rate defence of the MYR," says Barclays.

Malaysia June IP: Manufacturing resilience maintained

Tuesday, August 11, 2015 12:43 AM UTC

Editor's Picks

- Market Data

Most Popular