In the early months of 2022, Arun Sundararajan, the Harold Price Professor of Entrepreneurship at New York University’s Stern School of Business, explored the potential of established brands utilizing non-fungible tokens (NFTs) in a Harvard Business Review case study.

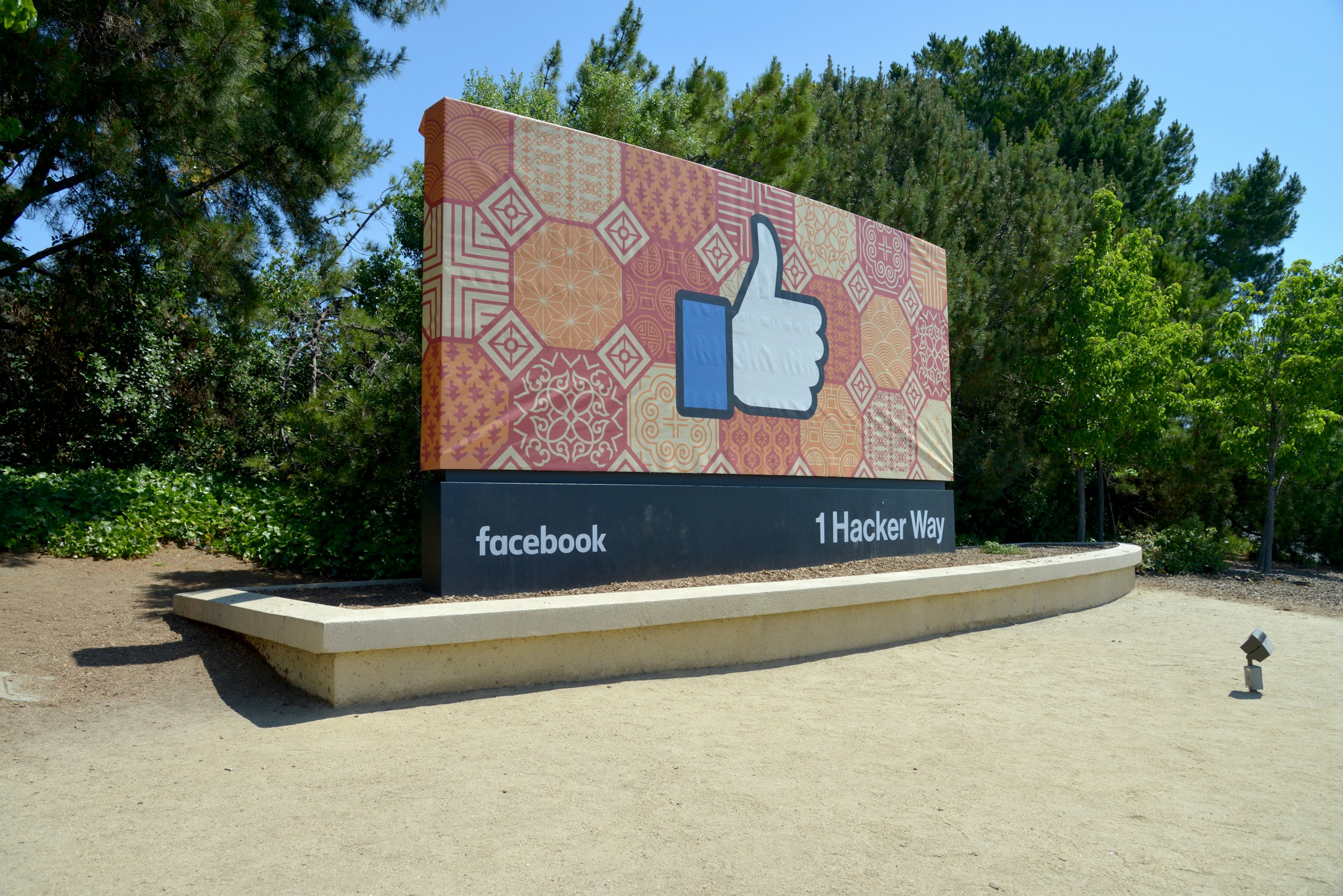

The piece delved into the rising trend of tech giants like Twitter and Facebook (now X and Meta, respectively) incorporating NFT avatars for enhanced user customization.

NFTs: From Hype to Reality, and Back Again

Sundararajan envisioned NFTs as a means to amplify conspicuous consumption in digital spaces, projecting a mainstream embrace of these digital assets in 2022.

However, the subsequent weeks witnessed an unexpected downturn in the entire crypto market, leading to a drastic decline in the NFT value. Meta, in response to its "year of efficiency," discontinued NFT functionality on its Instagram and Facebook apps, redirecting focus to areas where impactful scale could be achieved.

Meta's Crypto Conundrum: A History of Setbacks

This setback for Meta wasn't the first time its crypto ambitions faced obstacles. Previous endeavors, including the Libra stablecoin plan in 2019 and the subsequent Diem stablecoin effort, encountered regulatory hurdles and resource-intensive development before being abandoned.

According to Coin Desk, despite the market's apparent rebound, Meta's recent pivot toward artificial general intelligence (AGI) suggests a cautious stance on crypto adoption.

Meta now finds itself under congressional scrutiny, with Representative Maxine Waters questioning the company's crypto activities.

Waters, a ranking member of the Democratic House Financial Services Committee, expressed concerns over blockchain-related trademarks filed by Meta in 2022. The trademarks, indicative of Meta's potential expansion in the digital assets market, raise questions about the company's stated absence of ongoing digital assets work.

According to Kryptomoney, despite Meta receiving Notice of Allowance (NOA) documents from the U.S. Patents and Trademark Office, indicating approval for five blockchain trademarks, but the validity of these trademarks in signaling active crypto engagement remains uncertain. Waters' questioning anticipates Meta's response to these NOAs by February 15, underscoring the significance of Meta's potential reentry into the crypto space.

As the crypto industry evolves, the broader inquiry into Meta's intentions underscores the delicate balance established corporations must navigate when experimenting with blockchain and digital assets. Waters' vigilance reflects an awareness of the power regulators wield in shaping the trajectory of tech giants venturing into the crypto realm. The unfolding saga of Meta's crypto ventures continues to be a subject of national interest and speculation.

Photo: Greg Bulla/Unsplash

Ethereum Whales Just Loaded ~9 Million ETH — The Squeeze Is On

Ethereum Whales Just Loaded ~9 Million ETH — The Squeeze Is On  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Hovers Flat Near $68K Ahead of US-Iran Talks — Bulls Eye Break Above $70,050 for $78K Rocket

BTC Hovers Flat Near $68K Ahead of US-Iran Talks — Bulls Eye Break Above $70,050 for $78K Rocket  ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000

ETH Follows BTC Higher: $2056 and Climbing – Bulls Locked In Above $2000  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  ETHUSD Blasts Past $2000 Milestone — Following Bitcoin’s Lead, Bulls Charge Toward $2380–$2500

ETHUSD Blasts Past $2000 Milestone — Following Bitcoin’s Lead, Bulls Charge Toward $2380–$2500  Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary