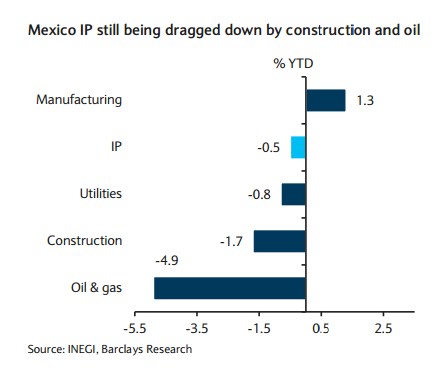

In Mexico, Q2 economic reports will be key to confirming our annual forecasts and giving us a better idea of the state of the economy. So far, the latest industrial production report, for May, suggests some downside risks. In particular, industrial production posted a month-onmonth contraction, with construction activities decreasing 1.5% m/m sa, while manufacturing partially reversed April's strong print, declining 0.9% m/m sa. Finally, mining rose 0.7% m/m sa as oil production recovered. In the year to date, IP has decreased 0.5%, dragged down by a contraction of 4.9% in oil and gas production and a 1.7% decrease in construction activities. Manufacturing, by contrast, has grown 1.3%, driven by a strong expansion in transport equipment (auto) of 3.7%.

Barclays notes:

- After the May report, we estimate that the GDP monthly proxy for May will contract by 0.5% m/m sa, setting our GDP tracker for Q2 at 0.4% q/q sa, below our current forecast (0.9%).

- We may review our forecast after the release of GDP data for May, due on July 24, and the IP report for June.

- If the expansion in Q2 is closer to our tracker, growth in 2015 could be closer to 2.2% y/y, which again would be a third consecutive disappointment on annual GDP growth and could spur doubts about the current potential growth of the economy, which we still believe is at 2.6% y/y.

- However, June data should be better. We believe that the contraction in manufacturing in May was temporary and that there should be a recovery, based on the latest PMIs (currently 53).

- Additionally, oil production increased 0.8% m/m sa in June. Finally, retail activity still seems healthy and formal employment expanded 0.6% m/m sa in June, which suggests that services might continue to support the domestic components of IP and growth overall.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022