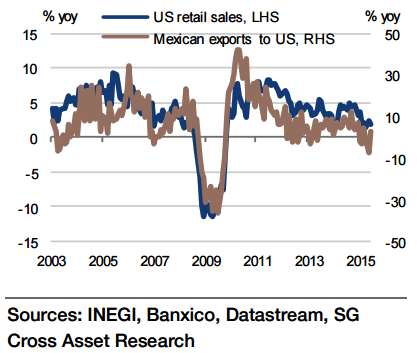

Year-to-date, Mexico's trade balance has worsened to -m from -m during the same period last year. The worsening trade balance primarily has to do with the fall in dollar exports growth (-2.2% year-to-date from 4.1% in Jan-Jul 2014) while imports growth have also slowed down (0% from 3.3%).

"For August, the trade balance is expected at -m as exports will likely grow 0.8% yoy and imports by 2.1% yoy. The figures above apart, real exports volume growth has been quite impressive this year and is gaining from strengthening US growth and Mexico's export competitiveness", says Societe Generale.

The shrinking dollar trade numbers, therefore, just show the significant depreciation of the peso this year. In 2014, exports grew by 4.6%, while imports were up 4.9% (versus 2.5% and 2.8% respectively in 2013). The current account balance improved slightly to -2.1% from -2.4% of GDP in 2013.

Falling oil prices have hit both the external account and Mexico's public finances. As a result, the current account balance deteriorated by between 0.5% and 0.8% of GDP on a structural basis, and it would take considerable improvement in manufacturing exports or penetration of new markets to see the current account return to its former size.

"However, it remains significantly below the much healthier -1.3% in 2012. In general, stronger manufacturing export growth in H2 2015 and 2016 should help keep the current account balance unchanged, although lower oil prices could also keep it from improving", added Societe Generale.

Mexico's trade deficit narrows as exports increase in dollar terms

Friday, September 25, 2015 5:43 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed