Brazil recorded 8.5% year on year inflation in June. Due to the inflation rate acclerate, the averate inflation projection for 2015 has been revied up. Societe Generale estimates the economy is likely to post 9.0% in 2015. With inflation currently well ahead of the target rate, the central bank may feel obliged to keep raising rates, particularly if the government is finding it difficult to control fiscal slippages and, therefore, manage BRL expectations.

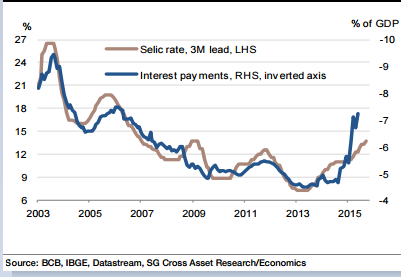

Societe Generale says, "A very high bank rate could theoretically help the BRL to stabilise and inflation to normalise, this would not be all that easy to achieve given the current macro/fiscal conditions. Therefore, the BCB is expected to raise the bank rate by 50bp to 14.25% at the July Copom meeting, leading to total tightening of 700bp in this cycle since April 2013."

Moreover, given the uncertainty on the BRL and inflation, the upside risk to their cyclical peak Selic rate forecast of 14.50% continues to rise, adds SocGen. A clear hint about an end to the tightening cycle at this stage could put further pressure on the currency.

As a result, while monetary policy cannot be successful in the current environment without fiscal and structural reform, the recent downgrading of fiscal targets clearly shows that monetary policy will remain the key tool for fighting inflation in this cycle, with the fiscal outlook remaining the key long-term structural concern, said SocGen in a report on Wednesday.

Monetary policy remains key tool for BCB

Wednesday, July 29, 2015 12:23 PM UTC

Editor's Picks

- Market Data

Most Popular