NZD/USD retracement from 0.6787 highs hit on Friday continues. Offered tone in the pair renews ahead of RBNZ meet tomorrow. Techs point south.

- RBNZ is widely expected to cut rates at tomorrow's meeting by 25 bps, to 2.50 percent. In the event it does cut there will likely be a "knee-jerk step down in the Kiwi.

- The pair fell to session lows at 0.6622. Selloff in oil and bulk commodities also weighed heavily on commodity currencies.

- Price action has been contained within the daily cloud, pair traded sideways within narrow 0.6622/60 corridor.

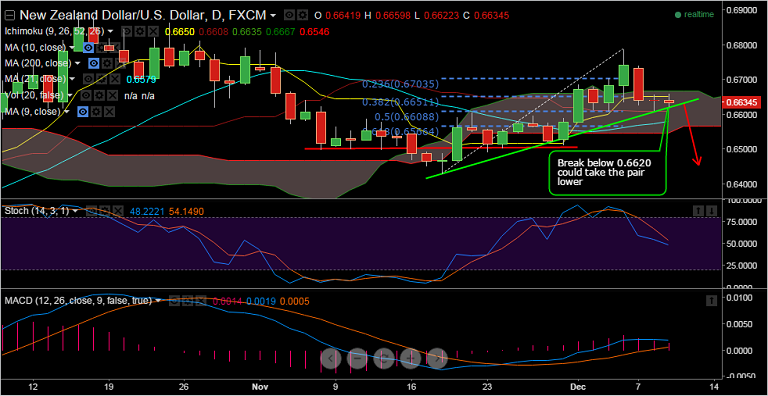

- Breaks below trendline support at 0.6620 would bring next support at 0.6612 in focus and further below 0.6608 (50% retrace Nov/Dec rise).

- Daily Tenkan at 0.6650 weighs on the topside ahead of cloud top at 0.6667 and then 0.6680 (Dec 2nd highs).

Recommendation: We would sell rallies around 0.6650, SL: 0.67, TP1: 0.6575, TP2: 0.65

Resistance Levels:

R1: 0.6650 (Daily Tenkan)

R2: 0.6667 (Cloud top)

R3: 0.6703 (23.6 % Fib of 0.6429 to 0.6787 rise)

Support Levels:

S1: 0.6612 (Dec 8 low)

S2: 0.6608 (50% retrace Nov/Dec rise)

S3: 0.6577 (Dec 1st low)