Technical glance:

On weekly charts, we are tracing out sufficient bearish calls,

The prevailing prices of this APAC pair falls well below 21DMA that signifies the long term downtrend to prolong, while leading oscillators shows downward convergence to the price dips.

More importantly, the formation of shooting star exactly at peak of 1.0999 levels to break the baseline of the descending triangle (see red colored circled area).

Leading indicators are clearly converging the ongoing price dips, RSI trending downwards around 49.7801 (while articulating).

Currency Option Strategy:

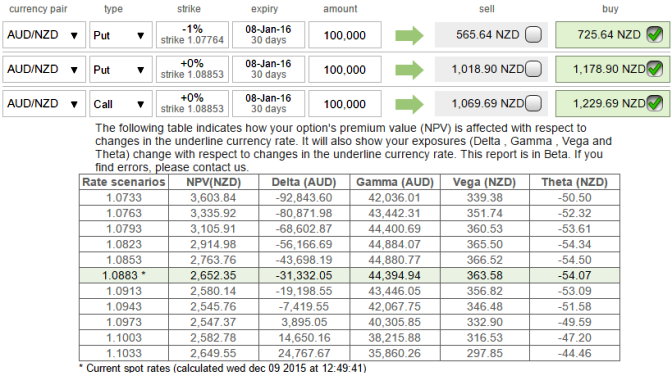

Contemplating above technical indications, the options strips strategy is advisable anticipating more downside potential.

Now have a look on the diagram from prevailing prices of ATM puts and they are moving in line with healthy delta.

Hold 15D At The Money 0.50 delta call and simultaneously hold 1 lot of 1M At The Money -0.48 delta put option and 1 lot of 1M (1%) out of the money -0.33 delta put option. Thereby strategy could be constructed with net delta at -0.31 and at net debit (i.e.trading more than 18% NPV).

We've been firm to hold on this strategy on hedging grounds. The potential target on upside is about 25-30 pips where 30-35 pips on downside or even below.

What makes ATM instrument more productive in our strategy: the delta of this instrument is here at its fastest rate and gets faster as your position come closer to the expiration date. As a result, time decay may have a relevant impact on ATM options.

The rationale is that any potential downswings should be optimally utilized, so to participate in that downtrend, weights in the portfolio should be doubled with ATM puts.

Huge profits achievable with the strip strategy when AUDNZD exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward move.

FxWirePro: More potential yields on AUD/NZD option strips, Extra ATM 0.51 delta put adds leveraging effect

Wednesday, December 9, 2015 7:28 AM UTC

Editor's Picks

- Market Data

Most Popular