New Zealand’s Fonterra has lifted its milk price forecast for 2017-18 (+0.15/kg MS) but marked down its dividend forecast (-USD0.10/share) and investment in Beingmate (-USD405 million to USD244 million; initial investment circa USD755 million).

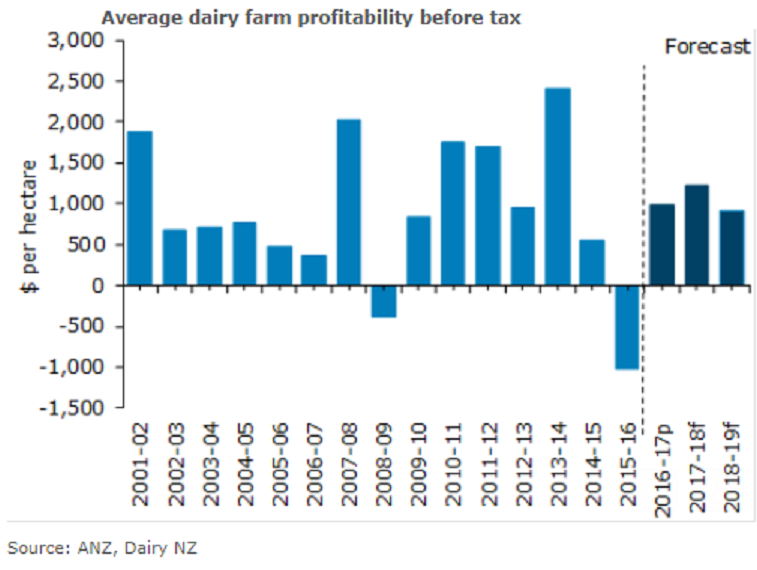

The lift in the 2017-18 milk price forecast to USD6.55/kg MS with the season near 86 percent sold was the major bright spot. This will be the fourth-highest result on record and helps underpin farm-gate earnings despite a difficult production year for most farmers.

A major talking point will be the USD405 million impairment of Fonterra’s Beingmate investment. The total write-down from the original investment is now USD511 million, which equates to USD0.32/share.

"The recent downward pressure on NZD and milk powder prices holding at the top of recent ranges create some upside risk, but we suspect international prices could be under a little bit of pressure into May on improved milk flow. The demand side of most dairy markets looks strong, meaning any downside should be fairly limited," ANZ Research commented in its latest report.

Meanwhile, autumn production conditions now look favorable, which will extend days in milk for most farmers, boosting end-of-season production. Still, overall NZ production is expected to finish down around 1.5 percent y/y, with large variations by region depending on the bite taken out of production during the hot and humid December/January period.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX