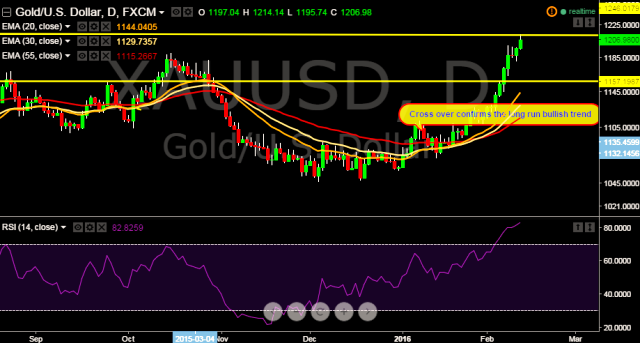

Gold prices were immediately affected by the Fed Chair Yellen speech. Pair broke the major resistance level at $1200 and made intraday high at $1214 marks.

- Intraday bias in Gold remains bullish for the moment.

- On the top side, key resistance levels are seen at $1218, $1225 and $1232 levels.

- Alternatively, a daily close below $1182 marks will turn bias bearish again.

- Fed chair Yellen will also have her second day of testimony to Congress later today.

- Moreover, falling Oil prices and worsening global oil supply glut are also responsible for the positive gold prices.

- Futures for WTI dropped 1.42% to trade at $27.06 per barrel, while Brent futures slipped 0.39% to $30.72 per barrel.

- Initial support levels are seen at $1200, $1192 and $1182.

- On the top side resistance levels are seen at $1214, $1218, $1225, $1132 and $1238.

We maintain our bullish trend for Gold. We prefer to take long position in XAU/USD around $1205, Stop loss $1182 and target $1238.