Today, International Energy Agency released its monthly oil market report, which remains quite bullish. The report suggests a tighter oil market. Here are the key highlights,

Global supplies:

- Global oil supply to 97.7 million barrels per day, however, it is still 1.5 million barrels per day higher compared to a year ago largely due to U.S. shale oil production.

- According to IEA, non-OPEC supplies declined by 0.175 million barrels per day in January to 58.6 million barrels per day but it is still 1.3 million barrels per day higher compared to a year ago.

- U.S. crude supplies are up 1.3 million barrels per day from a year ago and IEA forecasts that output would soon overtake Saudi Arabia and catch up with Russia by the end of the year.

- According to IEA’s calculation, non-OPEC compliance at 85 percent.

OPEC supplies:

- According to IEA’s calculations, OPEC produced 32.16 million barrels per day in January, boosting compliance to new heights of 137 percent. Higher output from Nigeria offset the decline in other OPEC members’ production.

- Declines are accelerating in Venezuela, which posted the world's biggest unplanned output fall in 2017.

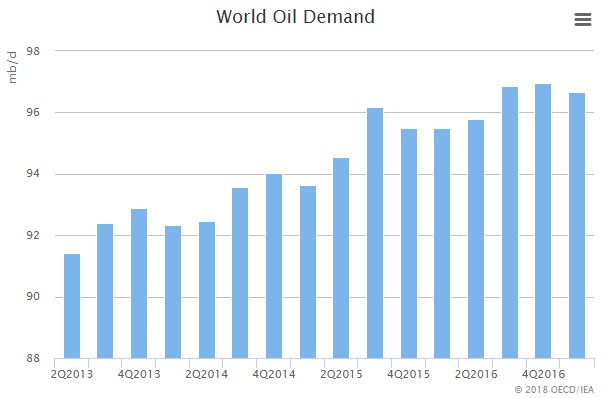

Global demand:

- IEA estimates demand growth for 2018 at 1.4 million barrels per day, which is higher compared to last forecast and IEA admits that the increase was due to higher growth forecast from the International Monetary Fund (IMF).

Global inventories:

- On the inventory side, IEA report shows that OECD commercial stocks declined for the fifth consecutive month in December, by 55.6 million barrels, with is the largest decline since February 2011.

- OECD commercial stocks are currently at 2,851 million barrels, which is 52 million barrels higher than the five-year average.

- Stocks declined 154 million barrels in 2017.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX