While the oil market continues to focus on supply/demand fundamentals, these are some key updates that you need to keep a tab on,

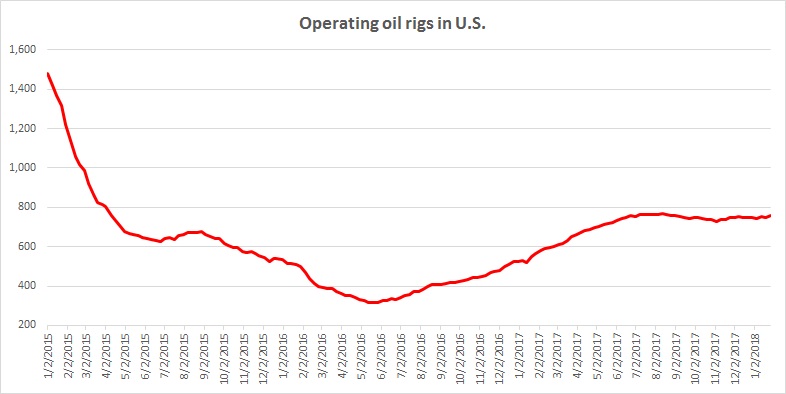

- U.S. oil rig count: The United States is continuing to see a surge in production. According to the latest report, the production declined to 9.88 million barrels per day. Despite fewer rigs operating compared to 2014/15, the production efficiency has pushed the overall production higher. As of latest report, the numbers of operating rigs rose from 747 to 759. The numbers of operating rigs have increased more than 150 percent since bottoming in May last year.

- Iranian sanctions: President Trump signed sanctions waiver on Iran but announced that this is the last time he is signing it and would end Iran Nuclear Agreement if a better deal cannot be reached. Iran has warned that could fasten the Uranium enrichment if the U.S. fails to keep their side of the bargain. Trump’s diplomatic team has arrived in Europe to discuss the U.S. reservations with regard to JCPOA.

- Venezuela crisis: Crisis continues in Venezuela. A country which has the largest reserve of crude oil is reportedly running low on gasoline. The oil production is dwindling too. Venezuelan parliament called President Maduro plan to raise $5.9 billion via cryptocurrencies backed by oil as illegal. The latest OPEC report suggests that Venezuela’s oil production declined to 1.745 million barrels per day.

- Texas boom: With North American oil benchmark hovering above $60 per barrel, Texas oil producers are expanding production and increasing rigs, which could lead to a beating of U.S. production forecast in 2018.

Key global oil benchmarks:

WTI - $66.1/barrel

Brent - $70.1/barrel

OPEC basket - $67.9/barrel

Urals - $69.5/barrel

Oman - $68.7/barrel

Dubai - $67.2/barrel

Western Canada Select - $38.4/barrel

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed