Drop in oil price, post financial crisis was due and to stay, however monetary stimulus from US FED and other major central banks just averted it temporarily. FED printed money in form of bond buying to boost demand. While the stimulus helped global economic demand to recover somewhat, it helped supply to rise more.

Today's oil world

Before financial crisis, contango in the oil market boosted financial demand in the sector, leading to larger supply and increased demand for oil. During the peak average contango, one could sell a standard 2 million barrels of oil at additional $14 million profit, if it could be stored for just three months. However, post crisis contango slowly disappeared but by the time cheap credit from FED was available to finance the trade to profit from lower contango. Cheap credit also helped increase US oil production that finally destabilize the market in summer of 2014.

One might point to with loose monetary policy gone and US crude production dropping, market might come to balance, however supply glut changed market's political dynamics too.

US crude export ban is now lifted, OPEC has become dysfunctional, Russia fighting hard for market share.

To add to all that, continuing debt driven crisis in Emerging markets and China slowdown means demand is likely to be weaker than expected. As a matter of fact, latest analysis from International Energy Agency (IEA) support this view.

Digging the past

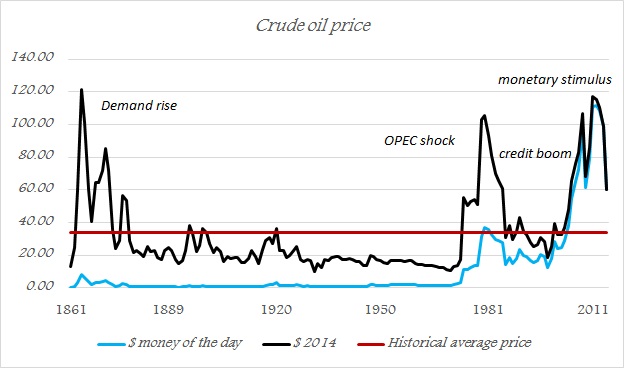

We, at FxWirePro, in search for historical clues checked history of oil price in British petroleum's energy review report that contains price dating back to 1861.

The data point that, considering the price at 2014's Dollar, average price of oil is coming around $34/barrel. Just around today's price.

In this 154 years of oil history, there has been three major oil price shock and few minors.

First one happened in 1860s period, when suddenly world found more use of this new found liquid. Considering modern oil history petroleum was found in 1848. However that shock was over with great American oil rush.

After the shock price remained below its longer term average for next 100 year except for two minor shocks at turn of the century and prior to great depression.

Next major shock was Arab oil embargo era. Though first embargo was imposed in 1967, real crisis era was 1974-1980. An era of Israeli war, Iran revolution. Major shock was over by 1980. Starting from 1974, it took price 11 years to settle below long term average.

Final shock -

After the80's shock, price remained depressed and broadly below its long run average ($34/barrel) for next 18 years.

Third shock was fuelled by credit boom in developed nations and financialization of commodities, which was funded by US FED even after 2008/09 crisis and finally the bubble burst in 2014 summer.

Since history has a tendency of repeating itself (in a similar but not same way), we might be sitting at the edge of long era of low prices.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed