The Philippines peso remained the worst performer amongst all Asian currency pairings over the past one month, following subdued investor confidence in the economy, given that is has been recently shaken by the recent string of negative news about President Duterte.

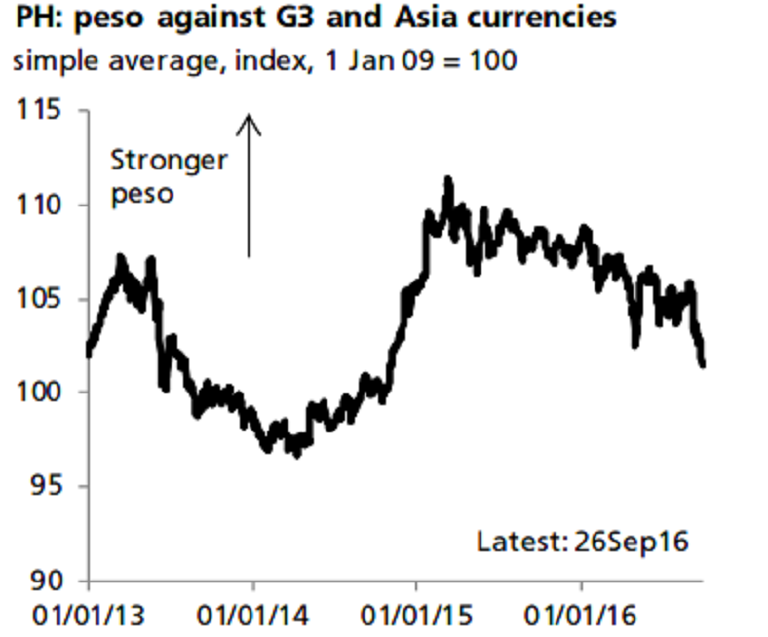

It is worth noting that up to a month ago, the peso was among the top performers in Asia since 2014. During 2Q14-1Q15, the peso gained almost 15 percent as compared to an average of Asia and G3 currencies.

However, there has been some room for the central bank to tolerate a softer currency, partly as normalization from the outperformance back then. Indeed, comments from government and central bank officials suggest that the policymakers are not too concerned about the peso recent moves, DBS reported.

The current account surplus has narrowed due to a slide in the exports of electronic products, and this might have intensified the central bank’s tolerance of a weak peso. Exports of electronic products were down 8 percent y/y during May-July 2016, a worrying sign given their importance to exports overall.

Meanwhile, domestic demand remains the main driver of overall GDP growth. Double-digit investment growth and private consumption growth, in excess of 6 percent means that the overall GDP growth would comfortably stay above 6 percent.

"Looking far ahead, how the government rolls out its economic policies will certainly have a bearing on foreign interest in the economy. At least for now, the macro picture still looks positive in our view," DBS commented in its latest research note.

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility